Media Strategy For Brand Growth: A 90-Day Blueprint To Integrate Paid-Earned-Shared-Owned For Acquisition, ROI, And Brand Equity

Introduction

Brand advantage in 2026 comes from integration. Fragmented attention and rising media costs reward operators who connect Paid, Earned, Shared, and Owned media into a single system.

Done well, this system acquires customers at efficient cost, builds brand placement where it matters, and converts with clear calls to action.

Social media sits at the center as the amplifier that turns narratives into measurable demand.

This document provides a practical framework to design a PESO strategy that is application agnostic across industries, with hospitality highlighted in depth. Fashion, tech, and CPG brands can deploy the same mechanics with category-specific calibration.

Designing the Future of Hospitality, Fashion, Tech, and CPG Brands

The commercial case is clear. OTA commission rates often fall in the 15 to 30 percent range, which dilutes contribution on third-party bookings and makes direct acquisition a priority for hotels and resort groups. Cloudbeds Industry outlooks indicate that direct digital channels are on track to rival or surpass OTAs by the end of the decade, a signal that owned and shared channels linked to performance media will carry a larger share of profitable demand. SkiftSkift Research In parallel, marketers are shifting budgets toward social and retail media, and many are expanding influencer programs, which raises the stakes for measurement and creative discipline. The Wall Street Journal

Billy Richards Consulting brings strategy plus creative direction, so that brands do not simply spend in more places, they align media with positioning, guest or customer journeys, and a clear conversion design.

The pages that follow outline the model, the playbooks by industry, the KPI architecture, and a 90-day plan to operationalize.

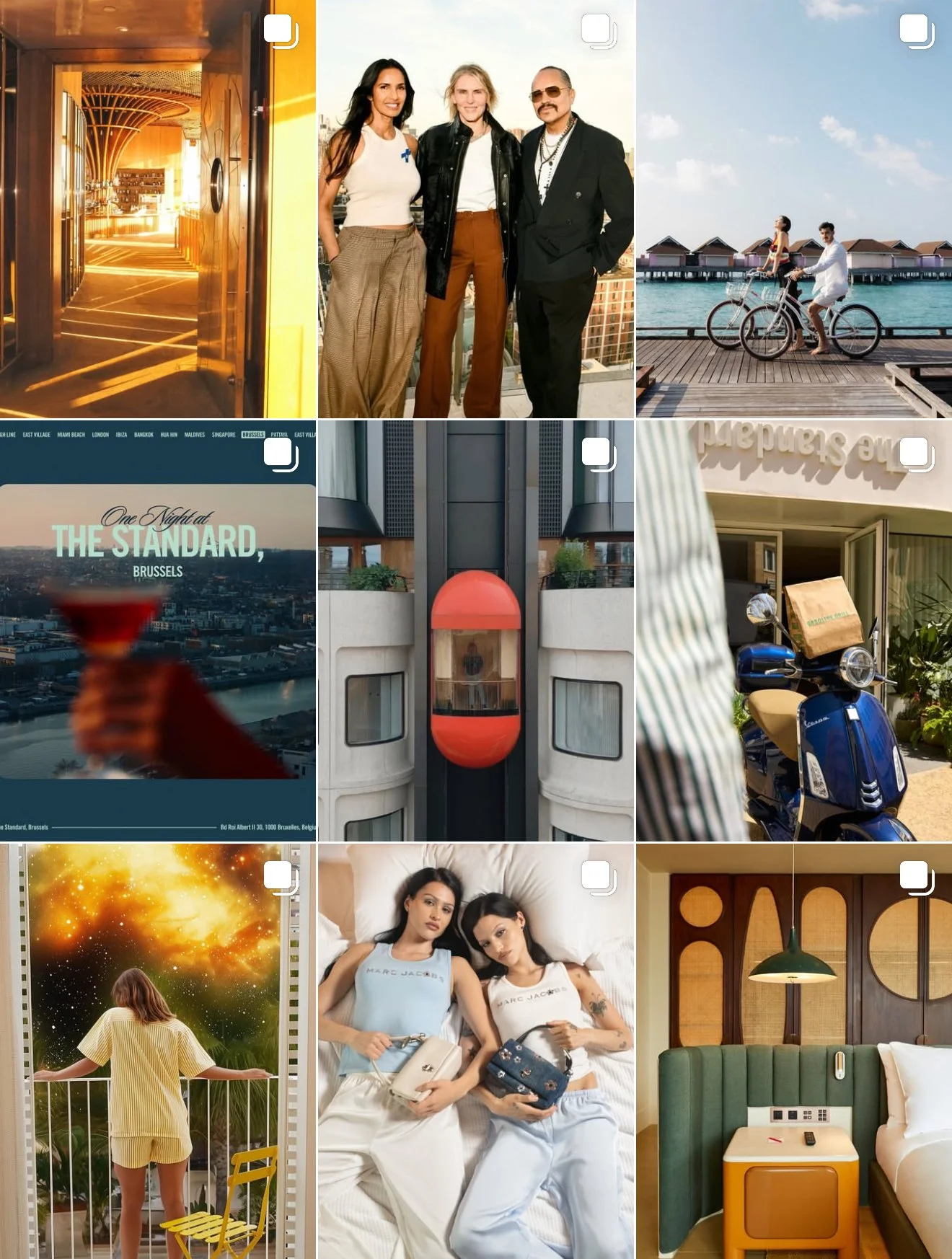

The Standard’s IG profile has 187k followers and has become a robust machine for owned story, shared by guests, amplified by paid to drive direct bookings.

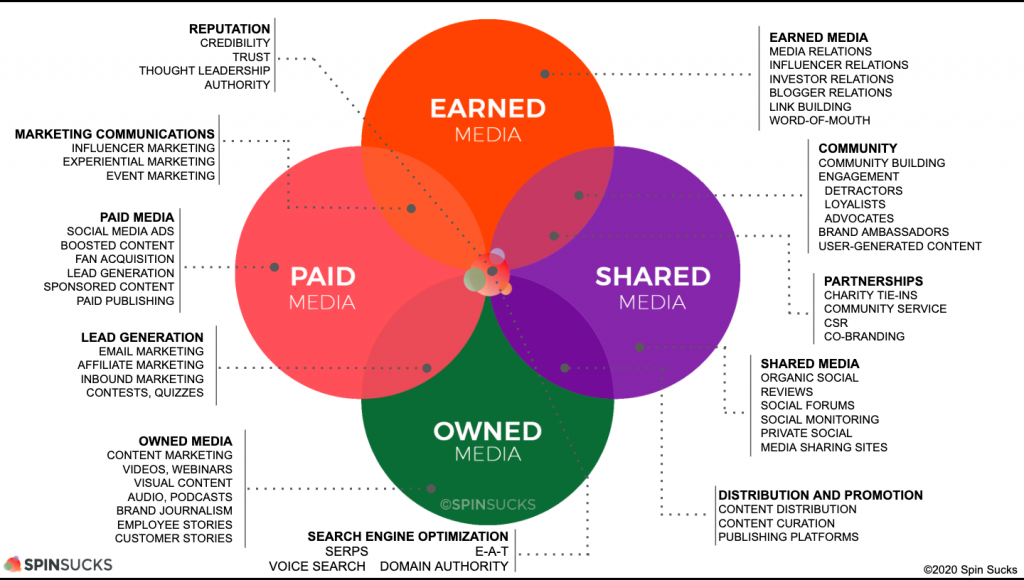

One. PESO Defined And Why It Matters Now

One narrative, four channels, one set of KPIs.

Paid covers investment to reach and convert targeted audiences. Think search ads, paid social, creator sponsorships, programmatic, and retail media networks. Paid media delivers immediate reach and controllable scale.

Earned is third-party validation. PR coverage, cultural institutions, editorial, reviews, and organic creator mentions build credibility that money cannot directly buy.

Shared is the social layer where your audience and partners co-create the message. It includes user-generated content, reposts, community interactions, and creator collaborations that travel across platforms. Shared is the multiplier that connects the other three.

Owned are the assets you control. Your site, booking engine or ecommerce, blog, video library, email lists, loyalty and CRM. Owned channels compound value over time and hold the data spine that ties back to ROI.

In 2026, the mix is shifting in two important ways. First, budgets continue to flow toward social and retail media with digital video also growing quickly, which means the creative bar and the measurement bar are both rising. Second, hotel distribution is trending toward a higher share of direct digital, a structural tailwind for owned site, email, and loyalty, supported by shared content and paid activation.Skift

PESO isn’t four silos, it’s one system with one set of KPIs.

PESO is one system, not four silos. Plan it as a single engine with one KPI spine that each channel supports.

Rename your planning doc from four separate sections to “PESO System.” Put one scorecard at the top with system KPIs, then map channel → objective → metric on one page.

Two. Social Media As The Engine

Social is not a side channel. It is the engine that turns narratives into traffic and traffic into revenue. Creators and communities shape culture and purchase intent across hospitality, fashion, tech, and CPG. Brand teams are responding by growing or protecting their influencer allocations and by using AI to manage workflows, identify fit, and measure incrementality. PR Newswire Many enterprise buyers also expect double-digit growth in social channel spend this year, which reinforces social’s central role in the mix. IAB

Micro and nano creators often deliver the strongest engagement-to-cost ratios, particularly in categories like beauty and lifestyle where authenticity and repetition beat a single hero post. Large agencies and holding companies are consolidating around creator platforms and identity data to connect influencer content to performance outcomes, which will make social investment more measurable and more defensible in budget cycles. Vogue BusinessThe Wall Street Journal

For hotels, shared media is where guest experience becomes market signal. UGC from a suite with skyline views or a chef’s table activation travels across Instagram and TikTok, gets reinforced by earned editorial, and lands on an owned booking path with a clear offer. As direct digital gains share, the return on social gets easier to see inside the marketing P&L. Skift

Some of the top creators in the luxury travel space delivering high-impact narratives that inspire aspiration, drive social engagement, and channel audiences directly to owned landing pages with premium direct booking offers.

Micro and nano creators drive outsized impact. Sustained series build trust and engagement at lower cost than one-off hero posts.

Lean into micro and nano creators. Build an always-on series instead of one-off campaigns. Repetition multiplies trust, lowers cost, and raises conversion.

Three. Industry Applications With Brand Examples

Hospitality and Hotels

Priority is total contribution per channel. OTA distribution still provides reach, but commission reduces margin. Direct booking share is a primary KPI, supported by loyalty growth and email list strength. Industry surveys project a more balanced mix ahead, with direct digital leading by the end of the decade CloudbedsSkift Research

Owned channels carry the narrative. A property site with compelling room type storytelling, sharp imagery, and a friction-light booking path is essential. Email sequences drive pre-arrival upsells and post-stay offers. Shared media transforms guest moments into discovery and social proof. Paid channels activate high-intent audiences around citywides, seasonal peaks, and key events.

At Billy Richards Consulting, we have collaborated with leading hospitality brands and cultural institutions such as Carnegie Hall, Lincoln Center, Whitney Museum, The National Arts Club, and American Folk Art Museum. These partnerships demonstrate how cultural alignment reinforces premium positioning and earns trust when programming and co-created experiences are amplified across channels. Similarly, our work with hospitality peers like Fairmont and The Standard showcases how consistent identity and programming can drive direct demand and rate authority.

Cultural alignment that produces earned stories and high intent traffic. Recording artist Rema performing at a Fairmont X Abbey Road collaboration.

Fashion

Owned content fuels search and long-tail discovery. Editorial lookbooks and behind the scenes posts provide Owned depth. Shared leans into creators and community styling. Paid social targets by interest, cohort, and intent. Earned in lifestyle press multiplies trust. Boutique labels like Gigi Burris and House of Puff show how craft, materials, and design language translate to platform-native storytelling that converts when connected to shoppable paths. Enterprise luxury groups like LVMH leverage both prestige media and precision targeting to stack reach with authority.

Creator CRM data increasingly shows that sustained partnerships, tracked across styling series and seasonal drops, lift conversion by as much as 20% compared to one-off campaigns.

Scenes from the LVMH Women’s S/S ‘25 show digital broadcast

Tech

Owned thought leadership matters. White papers, product explainers, and case studies build credibility. Analyst notes and developer shout-outs underscore trust. Shared showcases amplify team voice. Paid search and social harvest intent and move trials. Brands with electronics or display footprints, like Samsung and Apple, turn launches into cross-channel waves when landing pages, creator content, and performance media are planned as one system.

For SaaS models, the freemium-to-paid flow is critical, with trial conversions often delivering the largest ROI when paired with targeted retargeting.

Thought leadership is crucial to create human connection. Steve Jobs’ keynotes turned launches into cultural events, elevating him as the face of Apple and building mystique around both leader and brand. Today, Elon Musk, Tim Cook, Sundar Pichai, Satya Nadella, and Jensen Huang embody the same principle: people connect not just with products but with the vision and culture behind them. In a world where tech can feel abstract, leaders who step forward transform innovation into community and culture. When amplified through the PESO mix, this leadership content becomes highly shareable, turning key moments into earned reach, shared engagement, and long-tail brand equity.

CPG

Owned recipes, how-tos, and ritual content build everyday relevance. Earned lifestyle features and creator tastings add validation. Shared turns unboxings and review content into the modern shelf talker. Paid now includes retail media networks with high-intent audiences inside merchant ecosystems. RMN and digital video spend are expanding as buyers chase measurable sales lift. IAB+1 Category leaders and culture brands like Red Bull and LVMH show how event-driven content plus partnership ecosystems deliver reach that compounds.

Retail media investments work best when integrated with site analytics, allowing brands to attribute incremental sales lift within merchant ecosystems and validate channel contribution.

To celebrate the launch of a limited-edition "Muscat Flavor" Green Edition Red Bull, a color shooting event, " Red Bull COLOR SPLASH - Green vs Purple " was held at Yokohama World Porters in Japan in late August 2025. An example of CPG brand media and creator content strategy aligned to drive brand discovery and sales.

Add one measurable lever per category.

- Hospitality: track contribution by channel, not just occupancy

- Fashion: use creator CRM data to quantify conversion lift

- Tech: measure trial-to-paid flow in SaaS funnels

- CPG: connect RMN reporting with ecommerce analytics

Tailor PESO plays by industry. Hospitality, fashion, tech, and CPG use the same framework, but conversion mechanics differ. Hotels optimize direct booking share, fashion leans into creator CRM and shoppable content, tech scales freemium to paid, and CPG integrates retail media measurement.

Four. Client Acquisition, Brand Placement, And Conversion Design

A guest spots your hotel featured in a travel magazine, sees an influencer’s story on Instagram, clicks through to your booking engine, and finally chooses between “Book a Room” or “Get 10% Off” on mobile. That journey is not a single channel. It is a connected system.

Discovery → Consideration → Conversion. Acquisition is a system, not a channel.

Each step from Discovery → Consideration → Conversion plays a defined role in the PESO mix.

As shown in the graphic above:

Discovery begins with reach: editorial features, creator narratives, or performance media that spark awareness.

Consideration builds trust through engagement, reposts, reviews, and owned deep dives that answer objections.

Conversion happens on owned platforms with clear CTAs and frictionless paths to booking or purchase.

Message and incentive testing must be linked to contribution, not just clicks. A/B experiments like “Book Now” vs. “Get 10% Off” reveal which CTA drives profitable revenue.

For hotels, conversion lives on owned channels. Friction-light booking flows, strong room type copy, transparent fees, and easy-to-understand in-stay benefits all raise direct share. With mobile bookings growing, UX investment on owned platforms is now an industry expectation. According to ProStay, mobile devices now drive 60% of all hotel reservations, with last‑minute bookings via smartphones jumping 36% year‑over‑year NAVAN-AI .

For fashion and CPG, conversion happens in product detail pages, social shops, and retail media networks. For tech, it is often a trial or demo flow, where trial to paid optimization drives the highest ROI. Across all categories, the principle is the same: CTAs must be explicit, relevant to the moment, and tailored to audience segments.

Test CTAs for contribution, not clicks.

A/B “Book Now” vs “Reserve Your Stay” (or “Shop the Edit”). Optimize to profitable contribution.

Acquisition is a system. Map discovery → consideration → conversion with clear PESO roles at each step.

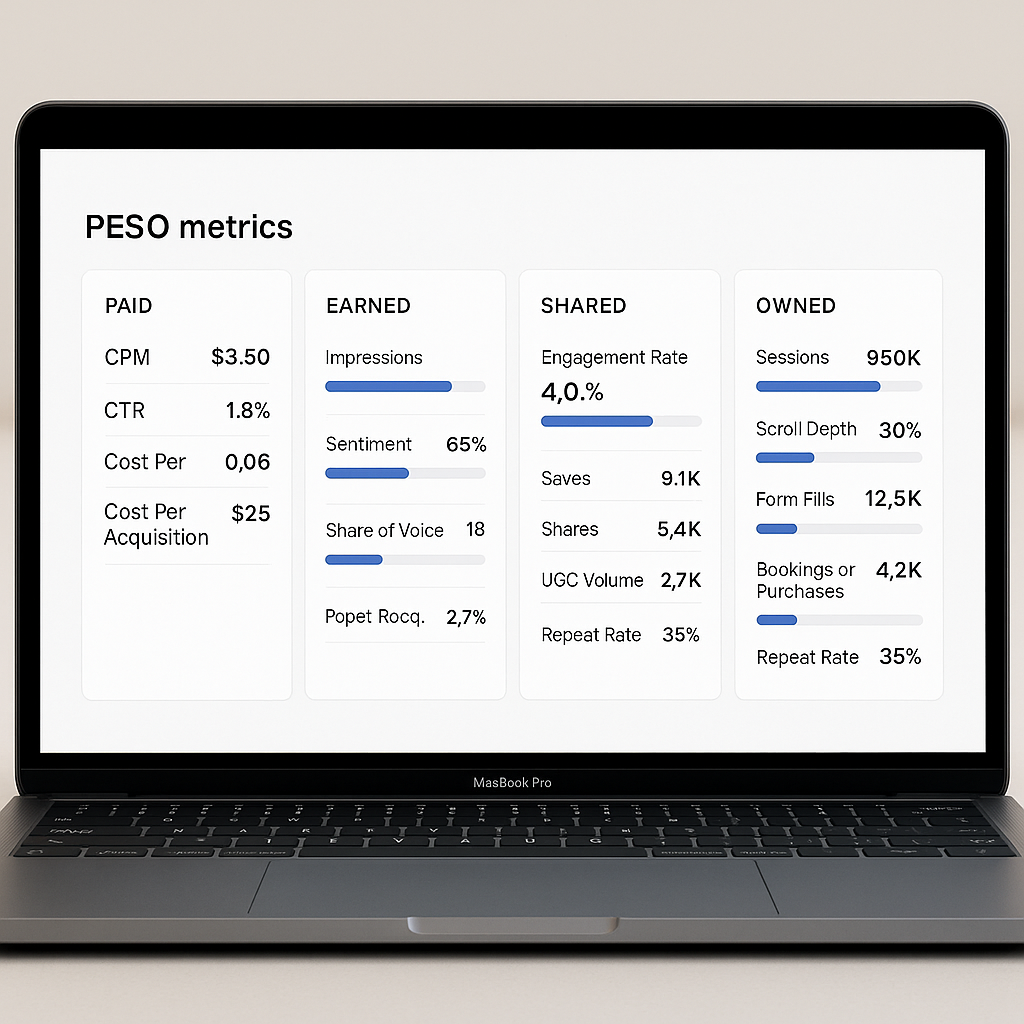

Five. KPIs And Measuring ROI

Measurement must prove that media investment converts to profit. The KPI stack should isolate channel performance and show the system effect.

Paid KPIs:

CPM (Cost per Mille/Thousand impressions)

CTR (Click-through rate)

Cost per view/click

Cost per acquisition (CPA), weighted by contribution margin

Earned KPIs:

Impressions

Sentiment

Share of voice

Referral conversions from media mentions

Shared KPIs:

Engagement rate

Saves and shares

UGC volume

Creator reach

Creator-driven conversions

Owned KPIs:

Sessions and scroll depth

Form fills

Bookings or purchases

Repeat rate

Email growth and attributable revenue

ROI Formula:

ROI = (Profit – Cost) ÷ Cost × 100

→ Attribute revenue using tracked links, promo codes, or post-purchase surveys.

Industry guides emphasize moving beyond vanity metrics toward revenue-aligned measures and offer practical models for tracking. Hootsuite Email continues to rank among the highest ROI channels, which is why owned list growth, deliverability, and testing belong in the core scorecard. EmailTooltester Content programs that live on owned surfaces produce compounding returns that support acquisition and retention. Content Marketing Institute

Hospitality operators should tie channel KPIs to direct booking share and contribution after acquisition cost. Distribution outlooks suggest a path toward larger direct digital share by 2030, which means the KPI architecture you install now becomes more valuable each quarter. Skift

Track your results.

Work off of one dashboard that reports by channel and by contribution.

Group KPIs by PESO for clarity:

- Paid: CPM, CTR, cost per view/click, CPA (weighted by margin)

- Earned: Impressions, sentiment, share of voice, referral conversions

- Shared: Engagement rate, saves, shares, UGC volume, creator reach & conversions

- Owned: Sessions, scroll depth, form fills, bookings/purchases, repeat rate, email growth & revenue

Measure profit, not vanity metrics.

ROI = (Profit – Cost) ÷ Cost × 100. Attribute revenue via tracked links, promo codes, or post-purchase surveys.

Six. Make Money With The Strategy

The goal is margin, not impressions. Here is how PESO becomes profit.

Reduce commission drag by moving repeatable demand into direct channels. Even a modest shift from OTA mix to direct improves contribution by the avoided commission range. Cloudbeds

Lower CAC with earned and shared. Third-party validation and UGC raise conversion rate and reduce paid media dependency at the margin. Recent market data shows brands evolving influencer portfolios toward micro and mid tier creators to increase engagement and cost efficiency. PR Newswire

Increase lifetime value through owned email and loyalty programs. Email remains one of the highest return channels and supports cross sell and repeat. DemandSage

Use retail media and digital video where they match category intent and carry measurable outcomes. Ad spend outlooks point to double digit growth in these areas as brands prioritize acquisition and performance metrics. IAB

Hotels should publish a channel contribution table monthly. Include booked revenue, acquisition cost, fulfillment cost variances if any, and net contribution. Tie exceptions to actions. When teams see the profit effect, they protect direct and allocate paid with discipline.

Reallocate just 5–10% of paid media spend from OTAs toward direct campaigns. Track the margin lift, even small shifts compound quickly.

Margin over impressions.

Even a modest shift from OTAs to direct can yield double-digit contribution gains. Protect direct business and allocate paid with discipline.

Seven. What To Keep In-House And Where To Partner

In-house ownership

Brand voice and community management so that the tone is consistent and responses are timely

Owned content maintenance on site and email so that updates are fast and accurate

Baseline analytics to validate weekly performance and flag anomalies

Partner with Billy Richards Consulting for:

Integrated PESO architecture that connects brand positioning with media roles and revenue targets

Creative direction that converts identity and guest or customer experience into platform-native stories

Cross-channel campaign planning with creator portfolios, cultural partners, and measurement plans

KPI dashboards that link social, PR, and paid to bookings or sales

Experience and partnership design that drives ancillary revenue in hospitality and brand extensions in fashion, tech, and CPG

A selection of some of our past and present project partners

Keep analytics, owned content, and brand voice in-house. Outsource execution-heavy work (e.g., influencer sourcing, large-scale media ops) to trusted partners.

Balance in-house control with expert leverage. Keep speed and accuracy by managing voice and data internally, while using partners for PESO integration and campaign scale without losing control.

Eight. Category Playbooks

Hotels and Hospitality

Narrative: Focus on guest identity and reasons to pay more. Spotlight suites, views, wellness, culinary, and cultural alignment.

Acquisition: Paid search for high intent, paid social for market entry, earned culture features, creator stays with clear disclosure.

Conversion: Direct booking offers pegged to value not rate. Loyalty and email nurturing.

KPIs: Direct share, contribution per channel, attachment revenue in stay.

Action: Design UGC programs with consent, guide rails, and reposting cadence. Run creator pilots across seasons. Leverage event calendars with partners to plan earned moments.

Fashion and Lifestyle

Narrative: Materials, silhouette, craft, and styling.

Acquisition: Seasonal paid bursts aligned to drops, editorial seeding for earned, micro creator styling series.

Conversion: PDP optimization and social shop links.

KPIs: New customer share, CAC by creator tier, repeat within 90 days.

Action: Create a modular lookbook template that feeds site, social, and email. Stand up a creator CRM.

Tech

Narrative: Product utility, social proof, and roadmap transparency.

Acquisition: Paid search and video, analyst relations for earned, developer or user community for shared.

Conversion: Trial to paid pathways, onboarding design.

KPIs: Trial conversion rate, payback period, activation milestones.

Action: Publish a quarterly insights piece as Owned gravity. Feed the best performing sections into short video and paid.

CPG

Narrative: Usage occasions, ritual, taste or performance.

Acquisition: Retail media plus paid social, creator unboxings for earned and shared.

Conversion: Retail media audiences, DTC bundles, repeat via email.

KPIs: Incremental sales in RMN, DTC repeat rate, creator assisted revenue.

Action: Build a measurement plan that pairs RMN reporting with site analytics. Industry sources show retail media and digital video expanding in 2026, which supports this investment. IAB

Action plays by sector:

- Hotels: design UGC repost programs and run creator pilots across seasons

- Fashion: build modular lookbooks feeding site, social, and email

- Tech: publish insights quarterly and repurpose into short video + paid

- CPG: align RMN reporting with ecommerce for full-funnel clarity

PESO execution is industry-specific, but the system stays consistent. Customize actions to sector needs while keeping measurement and integration uniform.

Nine. Data And Analytics To De-Risk Spend

Treat analytics as product. Install a source of truth that joins paid platform data, social engagement, PR placements, site analytics, booking or ecommerce revenue, and margin. Adopt a weekly scorecard with confidence intervals. Reference industry baselines so pacing is clear. Social ROI resources and calculators provide straightforward methods for tying outcomes to cost, which helps move budget toward what works. Social Media DashboardHootsuite

For hospitality specifically, use a distribution dashboard that reports the share from owned direct, OTA, brand.com if relevant, and other channels. Emerging research suggests direct digital will command greater share of bookings by 2030, so investments you make now in Owned and Shared will compound. Skift

Build a simple weekly scorecard. Track PESO metrics in one sheet and benchmark against industry baselines. It forces clarity and accountability without slowing teams down.

Treat analytics as a product, not a report. Join data across paid, earned, shared, and owned into one source of truth. Weekly scorecards make ROI transparent, defensible, and actionable.

Ten. Billy Richards Consulting Action Framework

1. Diagnose

Run a PESO architecture audit covering site performance, email health, social graph, creator portfolio, PR footprint, and paid accounts. Quantify distribution mix if you are a hotel operator and calculate net contribution after acquisition costs. Document positioning pillars and audience segments.

2. Design

Write a media thesis that links brand story to measurable outcomes. Define plays by funnel stage and by platform. Set a budget envelope and a target CAC or contribution threshold. Create a creator brief and PR calendar synced to product drops or key citywides.

3. Build

Stand up tracking, clean naming, and a simple attribution method you can explain. Produce the owned content spine first. Design social templates for speed. Recruit creators and cultural partners who match the story. Install dashboards with weekly and monthly looks.

4. Prove

Ship a 90-day pilot with 3 to 5 clear tests. Examples: creator tier test, CTA copy test, landing page variant, RMN placement type. Report results with error bounds and next steps. Keep the best, cut the rest.

5. Scale

Expand the top performing plays. Add spend to the combinations that meet CAC thresholds or contribution targets. Increase creator frequency where engagement justifies it. Introduce new partners as earned channels grow.

Pilot, prove, scale. Run 3–5 controlled tests in 90 days (creator tier, CTA copy, landing page variant). Keep what hits CAC/contribution targets and cut the rest. Double down on the winners.

Scaling is about discipline, not volume. Systematic testing and pruning create efficiency. The best plays get more spend, while weak ones are cut early, making growth predictable.

Eleven. The 90-Day Plan

Days 1 to 30

Conduct audit across PESO, distribution, and analytics.

Finalize positioning pillars and audience segmentation.

Build owned content spine: site pages, landing pages, email sequences.

Draft creator and PR briefs.

Stand up dashboards for paid, earned, shared, and owned.

Define tests and budget envelopes.

Days 31 to 60

Launch creator pilots and paid social or search activation.

Push earned stories to target outlets and cultural partners.

Publish two high value owned pieces that anchor search and email.

Drive UGC with on-property or on-brand prompts and consent.

Run 2 to 3 landing page or CTA experiments.

Days 61 to 90

Evaluate results against CAC or contribution thresholds.

Shift spend to top performing plays.

Plan season two with larger creator or partner footprint.

Lock in monthly governance: pricing or offer integrity, measurement quality, and brand safety protocols.

Break campaigns into 30-day sprints. Test creators, copy, PR hooks, and landing pages in fast cycles. Use each sprint to identify what drives CAC efficiency, then scale only the winners.

Think in 90-day cycles. Audit, design, launch, and measure within a 3-month window. This cadence keeps momentum high, ensures rapid learning, and doubles down on what meets contribution thresholds.

Twelve. Closing Synthesis And Call To Action

The integrated PESO model is not a trend. It is the operating system for brand growth in 2026 and beyond. Social is the amplifier. Owned is the compounding asset. Earned is the trust signal. Paid is the reach and precision. Hospitality operators can increase direct share and protect margin; fashion, tech, and CPG brands can lower CAC, scale launches, and build repeat. The outcome is clear: this system lowers acquisition cost, protects contribution, and compounds brand equity across channels.

Billy Richards Consulting partners with you as both creative strategist and operator. We align brand narrative, cultural partnerships, creator programs, and paid activation into a single, measurable system. We build dashboards, design experiments, and coach your teams. The outcome isn’t more content. It is more contribution and a stronger brand.

If you want a 90-day blueprint that turns your story into sales, attention into asset value, let us build it together.