The Convergence Imperative

2026 Strategic Framework for Hospitality Real Estate & Brand Integration

How Mixed-Use Hotel Development, Branded Residence Investment, and Lifestyle Brand Strategy Are Reshaping a $6 Trillion Market

2026 Strategic Framework for Hospitality Real Estate & Brand Integration

How Mixed-Use Hotel Development, Branded Residence Investment, and Lifestyle Brand Strategy Are Reshaping a $6 Trillion Market

Executive Summary: The $6 Trillion Convergence Opportunity

The hospitality industry is undergoing its most significant structural transformation in decades. The boundaries that once separated hotels, restaurants, real estate development, and brand building have dissolved. In their place, a new competitive logic has emerged: convergence.

This is not a trend. It is a structural shift in how value gets created.

This white paper presents ten strategic shifts defining the convergence imperative for hospitality owners, operators, and developers. The analysis synthesizes research from STR, CBRE, HVS, PwC, Baker McKenzie, Savills, Knight Frank, and WATG Advisory with two decades of advisory work across hotel repositioning, mixed-use development, and brand strategy.

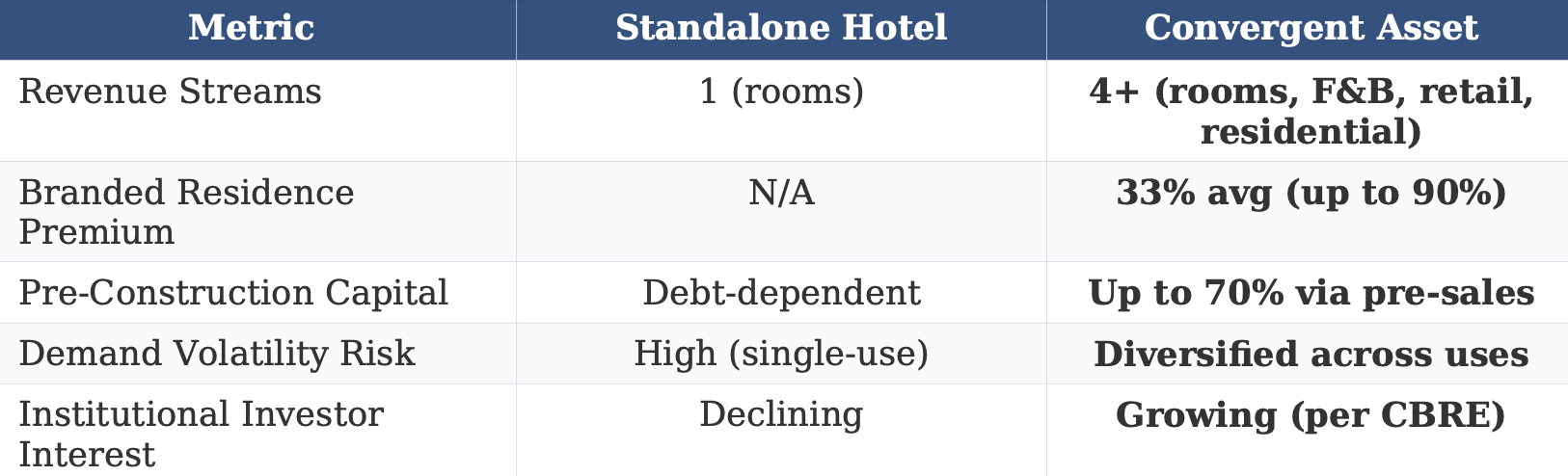

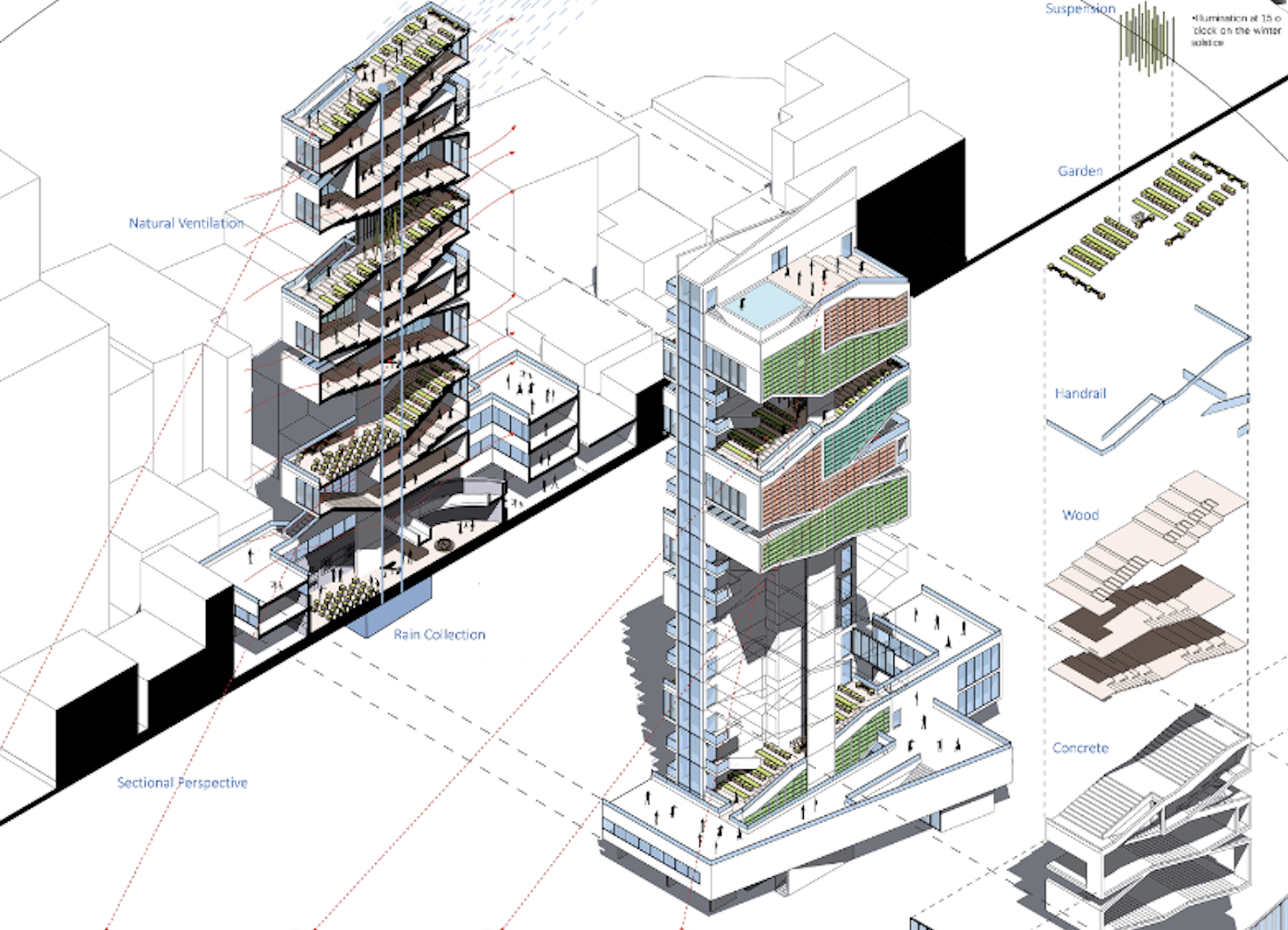

Standalone vs. Convergent Assets: The Performance Gap

The following comparison illustrates why institutional capital is shifting toward convergent hospitality assets:

The Core Thesis

A hotel is no longer merely a place to sleep. It is a platform for lifestyle expression, community creation, and multi-generational wealth building. The brands that will define the next decade are those that treat hospitality as strategy, not service.

Key Market Data

Branded residence investment premiums average 33% globally, exceeding 47% in emerging markets and 90% in select Dubai developments. Over 700 schemes now operate worldwide.

74% of diners now choose hotel restaurants as destinations, reversing decades of perception that hotel F&B represents compromise.

70% of loyalty members consider out-of-hotel benefits important, driving lifestyle brand ecosystem development.

Hospitality cap rate trends show a 202 basis point reset in Q3 2025, creating the most attractive asset repositioning opportunity in over a decade.

The Dissolution of Industry Boundaries

For decades, hospitality operated within clearly defined lanes. Hotels were lodging assets measured by RevPAR and occupancy. Restaurants were food and beverage operations measured by covers and check averages. Real estate development was a construction discipline measured by cost per key and time to stabilization. Brand building was a marketing function measured by awareness and sentiment.

These boundaries have collapsed.

The most compelling hospitality projects of 2025 defy categorization. The Langham Jakarta combines a luxury hotel with the 25hours Hotel The Oddbird, the ASHTA Mall, and the Treasury Tower office building in a single integrated development. Bluewaters Island in Dubai blends Banyan Tree and Delano hotels with branded residences, destination dining, retail, and the landmark Ain Dubai observation wheel. The Langsuan district in Bangkok, anchored by the Kimpton Maa-Lai and Sindhorn Kempinski, has become one of the city's premier dining and lifestyle destinations.

The macroeconomic environment of 2026 demands this convergent approach. With U.S. RevPAR projected flat to slightly negative and construction costs, insurance premiums, and debt service elevated, traditional single-use development economics have become increasingly challenging.

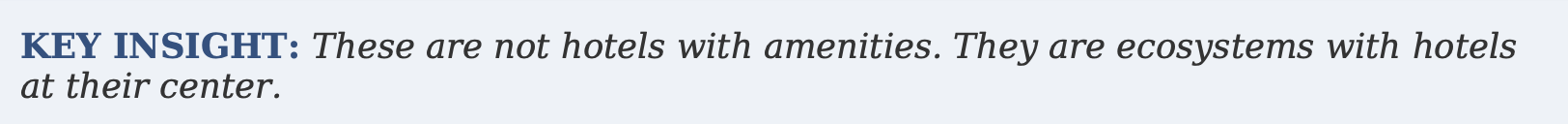

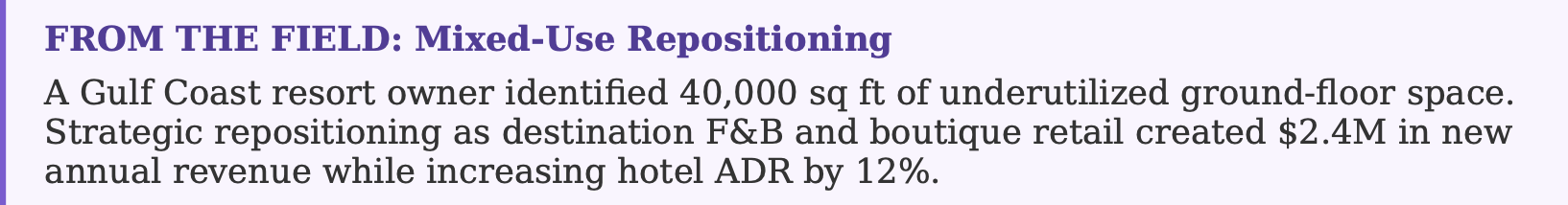

1. Mixed-Use Hotel Development Strategy: Why Standalone Assets Underperform

The standalone hotel is becoming an increasingly difficult investment thesis. Rising construction costs, elevated debt service, and margin compression from labor and insurance have shifted institutional capital toward mixed-use developments that distribute risk across multiple revenue streams while creating synergies that enhance each component.

Gensler's 2025 analysis of retail-driven mixed-use environments identifies hotels as integral contributors to urban vibrancy. A hotel provides a built-in customer base for ground-floor retail and dining. Those activated uses create reason for guests to choose the property over competitors.

The Design Imperative for Mixed-Use Integration

Hotels within mixed-use developments must create natural connections with pedestrian zones, retail corridors, and public spaces. A hotel lobby is no longer a check-in area. It is an active social space featuring cafes, bars, boutiques, and programming that draws both guests and locals.

Strategic Recommendations

Conduct site utilization audits to identify underutilized parcels.

Model revenue scenarios for hotel-only versus mixed-use configurations.

Establish partnership frameworks with retail, F&B, and residential developers before project inception.

Dissection + optimization

2. Branded Residence Investment: The 33% Premium Opportunity

Branded residences have emerged as one of the most compelling asset classes in hospitality real estate. Over 700 branded residence schemes operate globally, with an equal number in development.

Developer Value: Pre-Sales as Construction Capital

Branded residences provide early capital returns through pre-sales funding subsequent construction phases. Deposits of up to 70% before handover reduce financing exposure and may eliminate debt reliance entirely

Brand Value: Permanent Ownership Relationships

The residential component extends guest relationships beyond transient stays to permanent ownership. Management agreements generate fees of 2-3% of property value and rental income. Residential owners become brand ambassadors.

Buyer Value: Premium Performance

Savills reports branded residence premiums of 33% globally, exceeding 47% in emerging markets and reaching 90% in select Dubai developments. Knight Frank notes significant shift toward standalone branded residences driven by demand for privacy.

3. Hotel F&B Brand Strategy: The 74% Destination Dining Shift

Food and beverage has transformed from departmental cost center to active driver of brand identity, guest acquisition, and community integration. F&B now defines competitive position and justifies meaningful rate premiums.

Hotel Management's 2025 survey found 74% of diners choosing hotel restaurants as destinations. This reverses decades of perception that hotel F&B represents compromise.

F&B Brands Crossing Into Hospitality

Nobu Hotels demonstrates how culinary identity anchors entire guest experiences. Sunset Hospitality's METT Singapore shows how entertainment-led F&B concepts define hotel positioning from inception.

Nobu Hotels, Atlanta

Strategic Recommendations

Audit F&B operations for destination potential.

Identify opportunities to create distinct sub-brands.

Evaluate partnership models with established operators who bring built-in audiences.

4. Lifestyle Brand Ecosystems: Why 70% of Loyalty Members Want More

The most valuable hospitality brands in 2026 are not hotel companies. They are lifestyle ecosystems that happen to include hotels. This distinction shifts strategic focus from optimizing properties to building interconnected platforms capturing guest value across multiple touchpoints.

The Loyalty Evolution

Global Hotel Alliance's 2026 survey: 70% of loyalty members consider out-of-hotel benefits important. Younger travelers view loyalty programs as personal ecosystems extending into dining, wellness, shopping, and lifestyle.

The Aman Model

Aman exemplifies the realized lifestyle ecosystem. Aman Beverly Hills, with six- figure nightly rates, offers access blending: hotel, residences, and private club membership. Guests purchase membership in a community defined by shared aesthetic values.

The entrance to the Aman, Beverly Hills

Strategic Recommendations

Map guest journeys beyond the property to identify lifestyle touchpoints.

Prioritize categories with emotional resonance and defensible brand fit.

Structure licensing agreements protecting integrity while enabling expansion.

5. Hospitality Asset Repositioning: The 202 Basis Point Opportunity

Development economics in 2026 favor repositioning over new construction. Rising costs, constrained capital, and ESG pressures are driving investors toward renovation strategies unlocking embedded value in existing assets.

The Current Opportunity Window

Crexi's 2026 Outlook confirms: after two years of transaction paralysis, capital is returning selectively, with cap rates jumping 202 basis points YoY. This reset has created the most attractive basis levels in over a decade.

Three Dimensions of Effective Repositioning

Effective repositioning addresses three dimensions in coordination: physical refresh of guest-facing spaces, operational restructuring aligning staffing with target positioning, and narrative repositioning reframing property identity.

6. Strategic Partnership Architecture for Complex Projects

Converged hospitality projects demand partnership structures aligning diverse stakeholders. Developer, operator, brand, F&B partner, retail tenant, and residential buyer each bring different objectives. Partnership architecture determines whether projects achieve synergy or succumb to friction.

The Branded Residence Partnership Template

Baker McKenzie identifies branded residences as template for effective architecture. Typical structures separate capital ownership (developer and buyers), operational management (hotel brand), and brand licensing with clear definitions of responsibilities, fees, and standards.

F&B Partnership Models

Rather than operating restaurants internally, hotels increasingly partner with established culinary operators bringing proven concepts, trained teams, and built-in audiences.

Strategic Recommendations

Define partnership criteria including track record, brand alignment, and financial capacity. Structure agreements with performance benchmarks, cure periods, and exit provisions.

The Bulgari residences in Dubai

7. ESG in Hospitality: From Optional Reporting to Requirement

Environmental, social, and governance considerations have moved from optional reporting to fundamental development criteria. Regulatory pressure, investor requirements, guest expectations, and operational economics now align around sustainability.

Regenerative Hospitality

Baker McKenzie's 2025 analysis notes regenerative hospitality emerging as new standard. Operators aim to positively impact environments and communities rather than merely minimize harm.

The Commercial Case

Properties with verified environmental credentials report higher win rates in corporate RFPs. ADR premiums of 2-5% for certified properties are documented. Accor and IHG have committed to portfolio-wide certification by 2030.

Strategic Recommendations

Establish baseline carbon, water, and waste metrics.

Develop five-year sustainability roadmaps with quantified targets.

Pursue third-party certification.

Aim to create mindful experiences to guide your guests towards transformative moments

8. Technology-Enabled Placemaking in Mixed-Use

Technology's role has evolved beyond operational efficiency to a fundamental placemaking element. Properties defining 2026 integrate technology as invisible infrastructure enhancing human connection across venues.

AI and Unified Guest Intelligence

PwC identifies AI adoption accelerating across hospitality. The significant development is integration across mixed-use environments, creating platforms recognizing guests whether checking in, dining, shopping, or visiting the spa.

The Human Element

Technology should augment staff capability rather than replace human warmth. The goal is freeing team members from routine tasks to focus on genuine connections defining exceptional hospitality.

Strategic Recommendations

Audit technology infrastructure for integration capability.

Establish common guest identity standards across venues and partners.

Tech-Enabled Placemaking has potential to create massive impact

9. Community Integration as Competitive Advantage

The most successful developments of 2026 achieve genuine community integration. This is fundamental strategic choice affecting site selection, design, operations, and long-term value.

The Neighborhood Anchor Model

A hotel functioning as neighborhood anchor, providing programming, employment, and gathering space, builds stakeholder relationships translating into regulatory preference, community support, and advocacy reducing acquisition costs.

Workforce Development

Operators prioritizing local talent recruitment and development build loyalty and institutional knowledge improving service quality over time.

Strategic Recommendations

Conduct community stakeholder mapping.

Develop programming including locally-oriented events.

Establish workforce pipelines creating career pathways.

Imagine your project as a meeting place for its community

10. Portfolio Strategy for Convergent Assets

Hospitality real estate convergence demands corresponding portfolio strategy evolution. Traditional approaches evaluating hotels as standalone assets must yield to frameworks capturing value across multiple use types.

Market Opportunity

Mordor Intelligence reports hospitality real estate at $4.91 trillion in 2025, projecting $6.04 trillion by 2030 (4.23% CAGR). Fastest growth at 6.14% CAGR projects for Middle East and Africa.

The Synergy Premium

Mixed-use developments outperform standalone portfolios because components contribute demand and value to each other. Residential buyers become hotel guests. Hotel guests become restaurant customers. CBRE confirms institutional investors increasingly back these projects.

Strategic Recommendations

Evaluate existing portfolio for convergence potential.

Develop acquisition criteria prioritizing mixed-use sites.

Establish portfolio platforms enabling cross-property synergies.

2026 Implementation Roadmap

Hospitality real estate convergence is a structural transformation redefining value creation. Operators recognizing this shift will capture disproportionate returns.

Q1 2026: Assessment

Conduct convergence audits across portfolio. Identify priority assets for repositioning, mixed-use expansion, and branded residence development.

Q2 2026: Pilot

Launch pilot initiatives at 2-3 priority properties. Implement unified technology platforms. Develop ESG roadmaps.

Q3 2026: Scale

Scale successful pilots. Execute partnership agreements. Advance branded residence development for qualifying assets.

Q4 2026: Consolidate

Lock 2027 capital allocation. Document metrics demonstrating value creation from integrated strategies.

Schedule a Convergence Strategy Session

This framework represents a strategic foundation. Execution requires expertise in hospitality operations, real estate development, and brand building, combined with judgment in navigating convergent project complexity.

Billy Richards is the founder of Billy Richards Consulting, a hospitality strategy practice specializing in convergent asset development, brand positioning, and guest experience design. With two decades of advisory experience spanning luxury hotels, mixed-use developments, and lifestyle brands, Billy has worked with Fairmont, The Standard, LVMH, Diageo, Samsung, Lincoln Center, and leading developers across North America, Europe, and LatAm.

Case Outcome (NYC-based Real Estate Developer)

Engagement areas:

• Convergence audits and portfolio strategy

• Mixed-use project advisory and partnership structuring

• Branded residence feasibility and development strategy

• F&B repositioning and operator identification

• Asset repositioning: physical, operational, and narrative

• ESG roadmap development and certification strategy

Ready to explore what convergence means for your portfolio?

Schedule a Convergence Strategy Session

Billy Richards Consulting

Hospitality Strategy & Brand Development

Gramercy Park, New York City

© 2026 Billy Richards Consulting. All rights reserved.

Media Strategy For Brand Growth: A 90-Day Blueprint To Integrate Paid-Earned-Shared-Owned For Acquisition, ROI, And Brand Equity

In 2026, the brands winning market share are not just spending more. They are integrating better.

This new white paper from Billy Richards Consulting reveals how to unite Paid, Earned, Shared, and Owned media into a single high-performance growth engine. With social media as the amplifier, this 90-day blueprint delivers measurable ROI across hospitality, fashion, tech, and CPG. It offers a cross-industry analysis that shows how the same core strategy can be adapted to each sector while respecting its unique dynamics.

Whether you are a boutique hotel or a global lifestyle brand, the fundamentals are the same. Creative clarity, disciplined execution, and KPIs that tie attention directly to revenue. Packed with up to the minute data, industry specific strategies, and a clear path from strategy to profit, this is the guide for leaders ready to turn brand presence into tangible asset value.

Introduction

Brand advantage in 2026 comes from integration. Fragmented attention and rising media costs reward operators who connect Paid, Earned, Shared, and Owned media into a single system.

Done well, this system acquires customers at efficient cost, builds brand placement where it matters, and converts with clear calls to action.

Social media sits at the center as the amplifier that turns narratives into measurable demand.

This document provides a practical framework to design a PESO strategy that is application agnostic across industries, with hospitality highlighted in depth. Fashion, tech, and CPG brands can deploy the same mechanics with category-specific calibration.

Designing the Future of Hospitality, Fashion, Tech, and CPG Brands

The commercial case is clear. OTA commission rates often fall in the 15 to 30 percent range, which dilutes contribution on third-party bookings and makes direct acquisition a priority for hotels and resort groups. Cloudbeds Industry outlooks indicate that direct digital channels are on track to rival or surpass OTAs by the end of the decade, a signal that owned and shared channels linked to performance media will carry a larger share of profitable demand. SkiftSkift Research In parallel, marketers are shifting budgets toward social and retail media, and many are expanding influencer programs, which raises the stakes for measurement and creative discipline. The Wall Street Journal

Billy Richards Consulting brings strategy plus creative direction, so that brands do not simply spend in more places, they align media with positioning, guest or customer journeys, and a clear conversion design.

The pages that follow outline the model, the playbooks by industry, the KPI architecture, and a 90-day plan to operationalize.

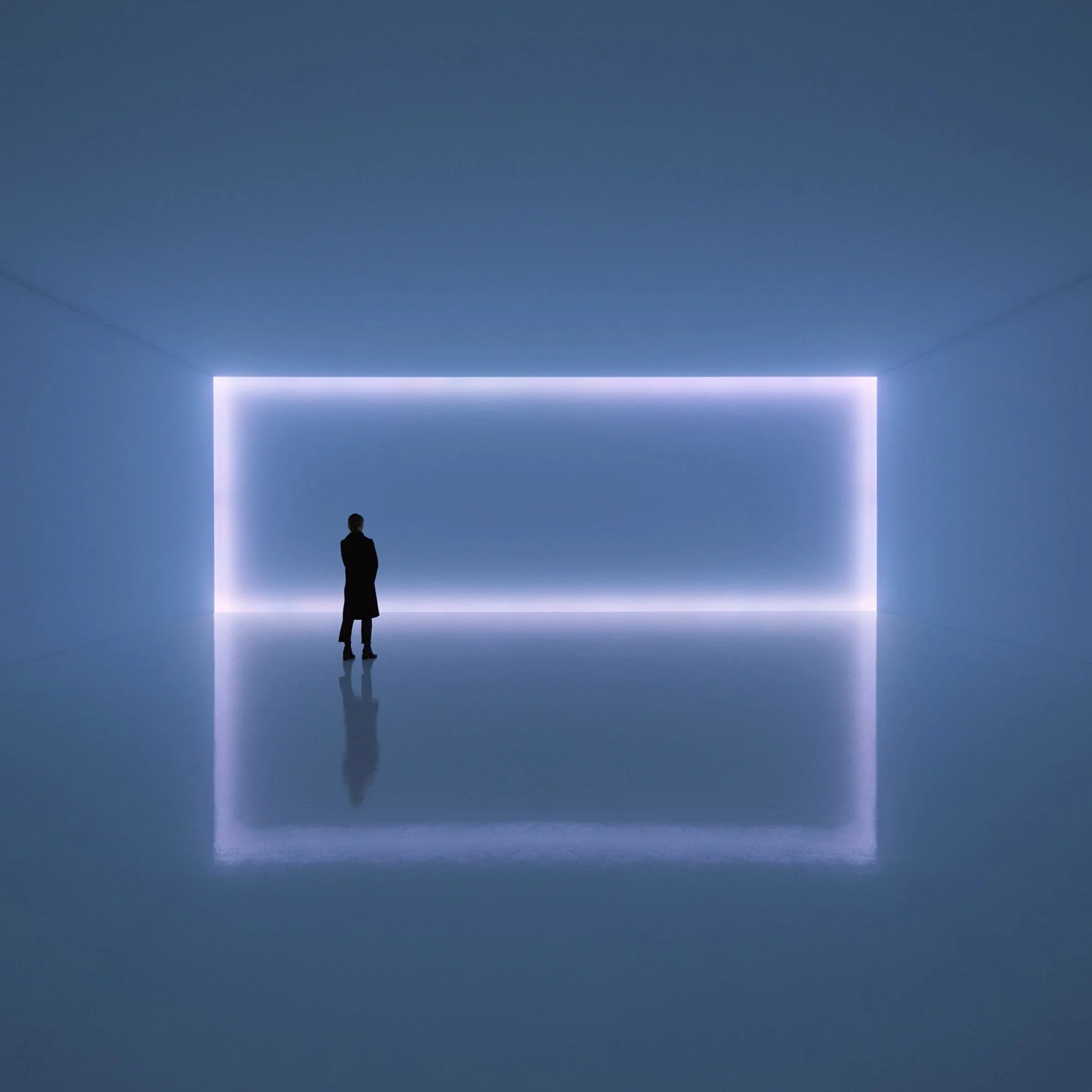

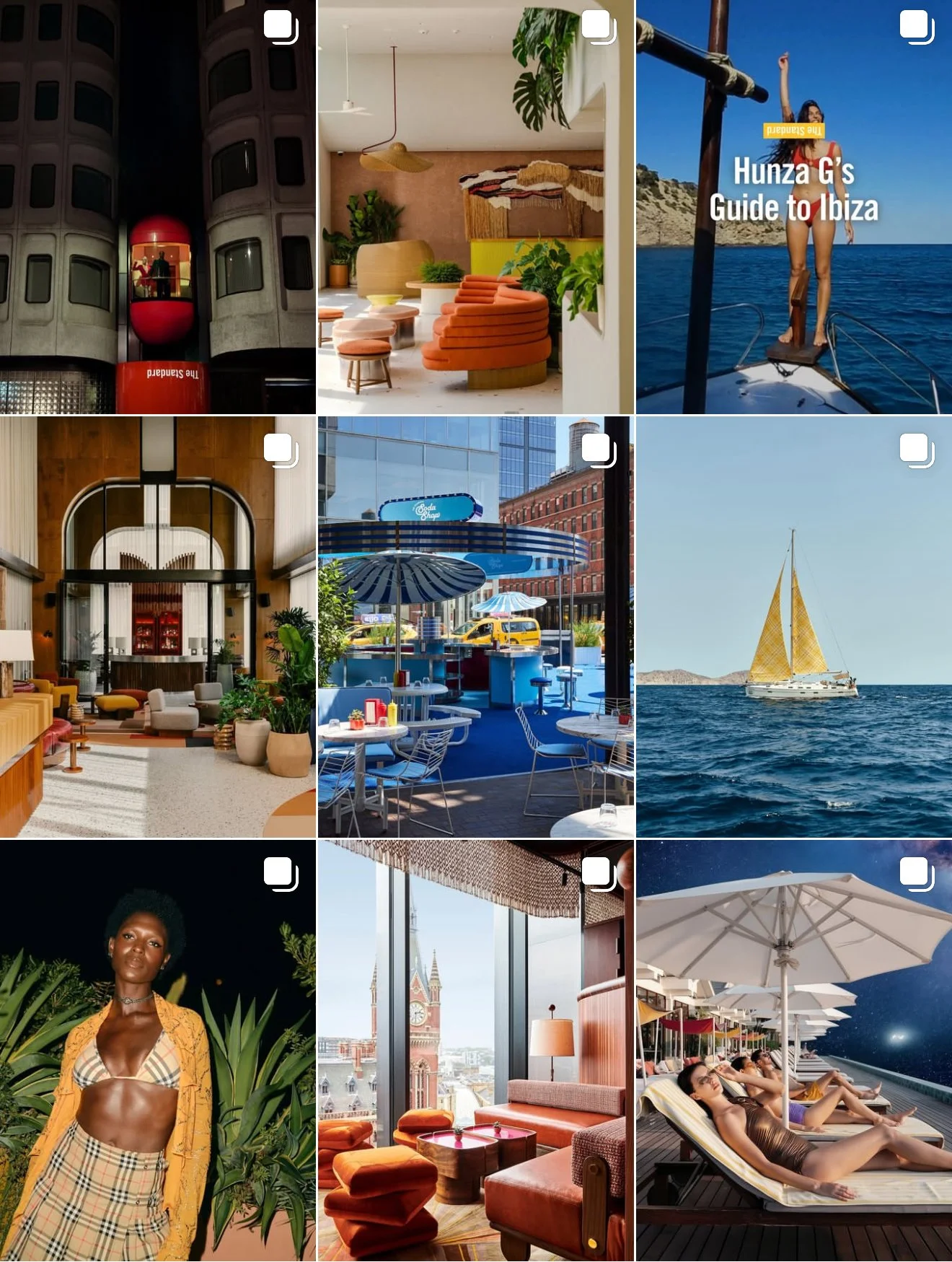

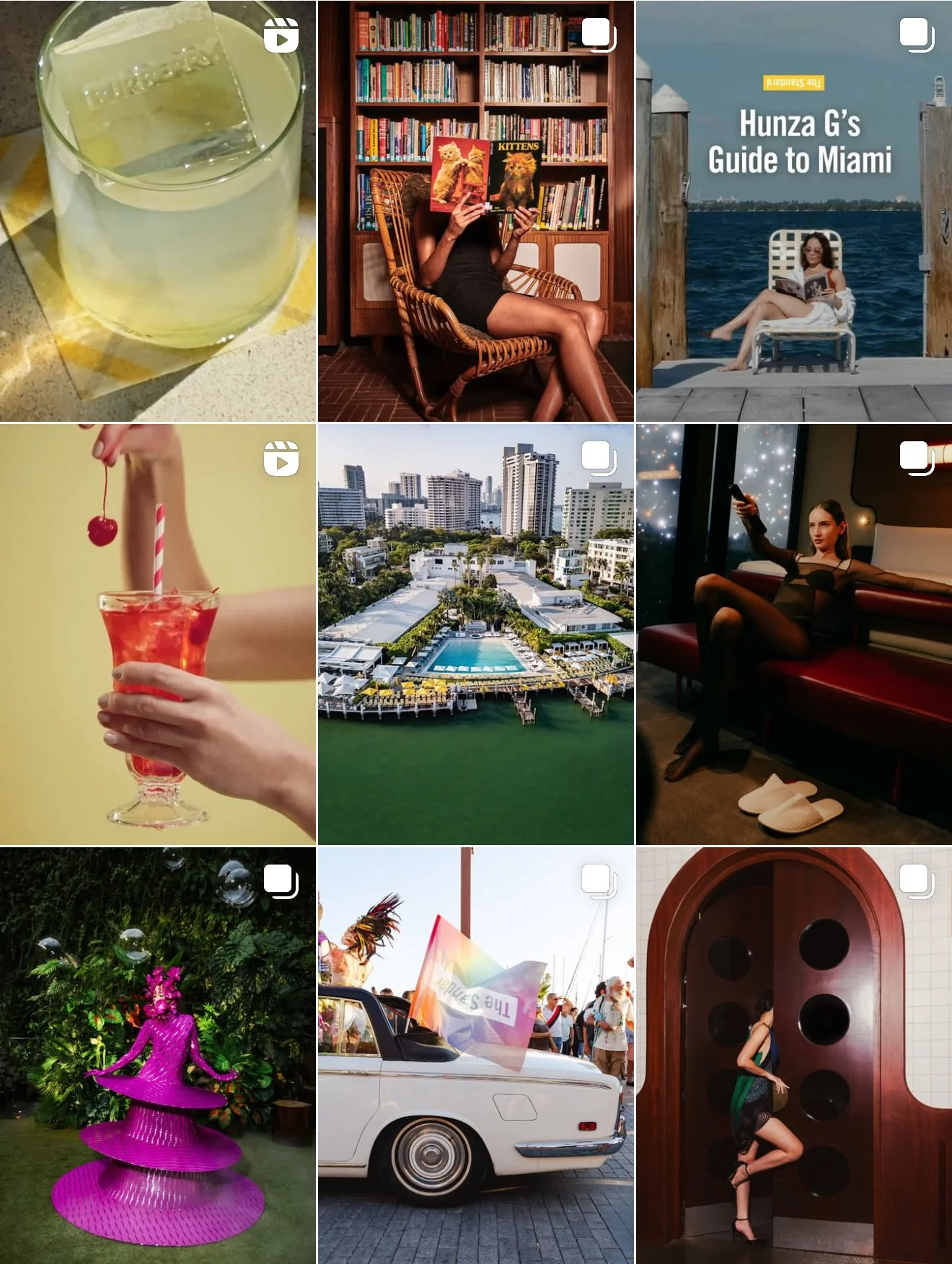

The Standard’s IG profile has 187k followers and has become a robust machine for owned story, shared by guests, amplified by paid to drive direct bookings.

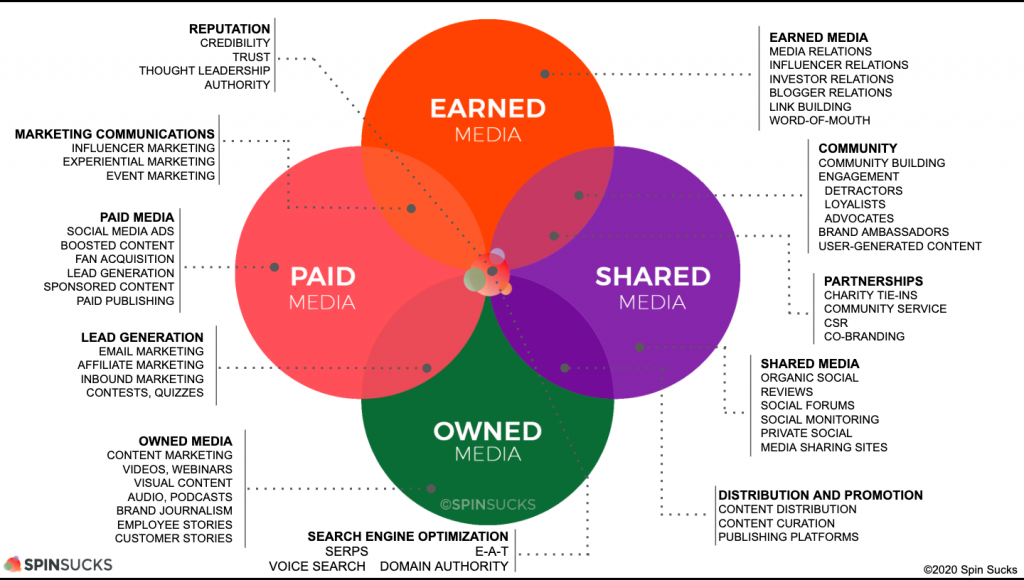

One. PESO Defined And Why It Matters Now

One narrative, four channels, one set of KPIs.

Paid covers investment to reach and convert targeted audiences. Think search ads, paid social, creator sponsorships, programmatic, and retail media networks. Paid media delivers immediate reach and controllable scale.

Earned is third-party validation. PR coverage, cultural institutions, editorial, reviews, and organic creator mentions build credibility that money cannot directly buy.

Shared is the social layer where your audience and partners co-create the message. It includes user-generated content, reposts, community interactions, and creator collaborations that travel across platforms. Shared is the multiplier that connects the other three.

Owned are the assets you control. Your site, booking engine or ecommerce, blog, video library, email lists, loyalty and CRM. Owned channels compound value over time and hold the data spine that ties back to ROI.

In 2026, the mix is shifting in two important ways. First, budgets continue to flow toward social and retail media with digital video also growing quickly, which means the creative bar and the measurement bar are both rising. Second, hotel distribution is trending toward a higher share of direct digital, a structural tailwind for owned site, email, and loyalty, supported by shared content and paid activation.Skift

PESO isn’t four silos, it’s one system with one set of KPIs.

PESO is one system, not four silos. Plan it as a single engine with one KPI spine that each channel supports.

Rename your planning doc from four separate sections to “PESO System.” Put one scorecard at the top with system KPIs, then map channel → objective → metric on one page.

Two. Social Media As The Engine

Social is not a side channel. It is the engine that turns narratives into traffic and traffic into revenue. Creators and communities shape culture and purchase intent across hospitality, fashion, tech, and CPG. Brand teams are responding by growing or protecting their influencer allocations and by using AI to manage workflows, identify fit, and measure incrementality. PR Newswire Many enterprise buyers also expect double-digit growth in social channel spend this year, which reinforces social’s central role in the mix. IAB

Micro and nano creators often deliver the strongest engagement-to-cost ratios, particularly in categories like beauty and lifestyle where authenticity and repetition beat a single hero post. Large agencies and holding companies are consolidating around creator platforms and identity data to connect influencer content to performance outcomes, which will make social investment more measurable and more defensible in budget cycles. Vogue BusinessThe Wall Street Journal

For hotels, shared media is where guest experience becomes market signal. UGC from a suite with skyline views or a chef’s table activation travels across Instagram and TikTok, gets reinforced by earned editorial, and lands on an owned booking path with a clear offer. As direct digital gains share, the return on social gets easier to see inside the marketing P&L. Skift

Some of the top creators in the luxury travel space delivering high-impact narratives that inspire aspiration, drive social engagement, and channel audiences directly to owned landing pages with premium direct booking offers.

Micro and nano creators drive outsized impact. Sustained series build trust and engagement at lower cost than one-off hero posts.

Lean into micro and nano creators. Build an always-on series instead of one-off campaigns. Repetition multiplies trust, lowers cost, and raises conversion.

Three. Industry Applications With Brand Examples

Hospitality and Hotels

Priority is total contribution per channel. OTA distribution still provides reach, but commission reduces margin. Direct booking share is a primary KPI, supported by loyalty growth and email list strength. Industry surveys project a more balanced mix ahead, with direct digital leading by the end of the decade CloudbedsSkift Research

Owned channels carry the narrative. A property site with compelling room type storytelling, sharp imagery, and a friction-light booking path is essential. Email sequences drive pre-arrival upsells and post-stay offers. Shared media transforms guest moments into discovery and social proof. Paid channels activate high-intent audiences around citywides, seasonal peaks, and key events.

At Billy Richards Consulting, we have collaborated with leading hospitality brands and cultural institutions such as Carnegie Hall, Lincoln Center, Whitney Museum, The National Arts Club, and American Folk Art Museum. These partnerships demonstrate how cultural alignment reinforces premium positioning and earns trust when programming and co-created experiences are amplified across channels. Similarly, our work with hospitality peers like Fairmont and The Standard showcases how consistent identity and programming can drive direct demand and rate authority.

Cultural alignment that produces earned stories and high intent traffic. Recording artist Rema performing at a Fairmont X Abbey Road collaboration.

Fashion

Owned content fuels search and long-tail discovery. Editorial lookbooks and behind the scenes posts provide Owned depth. Shared leans into creators and community styling. Paid social targets by interest, cohort, and intent. Earned in lifestyle press multiplies trust. Boutique labels like Gigi Burris and House of Puff show how craft, materials, and design language translate to platform-native storytelling that converts when connected to shoppable paths. Enterprise luxury groups like LVMH leverage both prestige media and precision targeting to stack reach with authority.

Creator CRM data increasingly shows that sustained partnerships, tracked across styling series and seasonal drops, lift conversion by as much as 20% compared to one-off campaigns.

Scenes from the LVMH Women’s S/S ‘25 show digital broadcast

Tech

Owned thought leadership matters. White papers, product explainers, and case studies build credibility. Analyst notes and developer shout-outs underscore trust. Shared showcases amplify team voice. Paid search and social harvest intent and move trials. Brands with electronics or display footprints, like Samsung and Apple, turn launches into cross-channel waves when landing pages, creator content, and performance media are planned as one system.

For SaaS models, the freemium-to-paid flow is critical, with trial conversions often delivering the largest ROI when paired with targeted retargeting.

Thought leadership is crucial to create human connection. Steve Jobs’ keynotes turned launches into cultural events, elevating him as the face of Apple and building mystique around both leader and brand. Today, Elon Musk, Tim Cook, Sundar Pichai, Satya Nadella, and Jensen Huang embody the same principle: people connect not just with products but with the vision and culture behind them. In a world where tech can feel abstract, leaders who step forward transform innovation into community and culture. When amplified through the PESO mix, this leadership content becomes highly shareable, turning key moments into earned reach, shared engagement, and long-tail brand equity.

CPG

Owned recipes, how-tos, and ritual content build everyday relevance. Earned lifestyle features and creator tastings add validation. Shared turns unboxings and review content into the modern shelf talker. Paid now includes retail media networks with high-intent audiences inside merchant ecosystems. RMN and digital video spend are expanding as buyers chase measurable sales lift. IAB+1 Category leaders and culture brands like Red Bull and LVMH show how event-driven content plus partnership ecosystems deliver reach that compounds.

Retail media investments work best when integrated with site analytics, allowing brands to attribute incremental sales lift within merchant ecosystems and validate channel contribution.

To celebrate the launch of a limited-edition "Muscat Flavor" Green Edition Red Bull, a color shooting event, " Red Bull COLOR SPLASH - Green vs Purple " was held at Yokohama World Porters in Japan in late August 2025. An example of CPG brand media and creator content strategy aligned to drive brand discovery and sales.

Add one measurable lever per category.

- Hospitality: track contribution by channel, not just occupancy

- Fashion: use creator CRM data to quantify conversion lift

- Tech: measure trial-to-paid flow in SaaS funnels

- CPG: connect RMN reporting with ecommerce analytics

Tailor PESO plays by industry. Hospitality, fashion, tech, and CPG use the same framework, but conversion mechanics differ. Hotels optimize direct booking share, fashion leans into creator CRM and shoppable content, tech scales freemium to paid, and CPG integrates retail media measurement.

Four. Client Acquisition, Brand Placement, And Conversion Design

A guest spots your hotel featured in a travel magazine, sees an influencer’s story on Instagram, clicks through to your booking engine, and finally chooses between “Book a Room” or “Get 10% Off” on mobile. That journey is not a single channel. It is a connected system.

Discovery → Consideration → Conversion. Acquisition is a system, not a channel.

Each step from Discovery → Consideration → Conversion plays a defined role in the PESO mix.

As shown in the graphic above:

Discovery begins with reach: editorial features, creator narratives, or performance media that spark awareness.

Consideration builds trust through engagement, reposts, reviews, and owned deep dives that answer objections.

Conversion happens on owned platforms with clear CTAs and frictionless paths to booking or purchase.

Message and incentive testing must be linked to contribution, not just clicks. A/B experiments like “Book Now” vs. “Get 10% Off” reveal which CTA drives profitable revenue.

For hotels, conversion lives on owned channels. Friction-light booking flows, strong room type copy, transparent fees, and easy-to-understand in-stay benefits all raise direct share. With mobile bookings growing, UX investment on owned platforms is now an industry expectation. According to ProStay, mobile devices now drive 60% of all hotel reservations, with last‑minute bookings via smartphones jumping 36% year‑over‑year NAVAN-AI .

For fashion and CPG, conversion happens in product detail pages, social shops, and retail media networks. For tech, it is often a trial or demo flow, where trial to paid optimization drives the highest ROI. Across all categories, the principle is the same: CTAs must be explicit, relevant to the moment, and tailored to audience segments.

Test CTAs for contribution, not clicks.

A/B “Book Now” vs “Reserve Your Stay” (or “Shop the Edit”). Optimize to profitable contribution.

Acquisition is a system. Map discovery → consideration → conversion with clear PESO roles at each step.

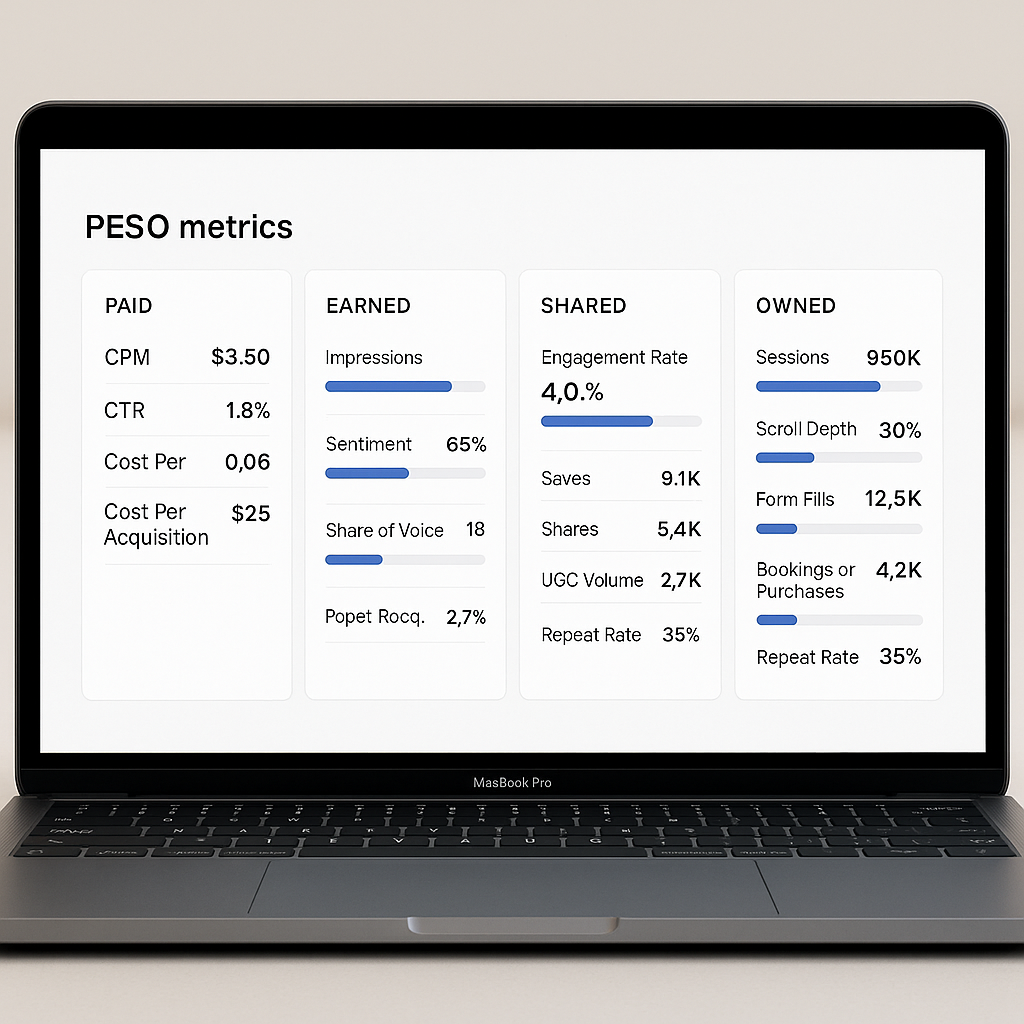

Five. KPIs And Measuring ROI

Measurement must prove that media investment converts to profit. The KPI stack should isolate channel performance and show the system effect.

Paid KPIs:

CPM (Cost per Mille/Thousand impressions)

CTR (Click-through rate)

Cost per view/click

Cost per acquisition (CPA), weighted by contribution margin

Earned KPIs:

Impressions

Sentiment

Share of voice

Referral conversions from media mentions

Shared KPIs:

Engagement rate

Saves and shares

UGC volume

Creator reach

Creator-driven conversions

Owned KPIs:

Sessions and scroll depth

Form fills

Bookings or purchases

Repeat rate

Email growth and attributable revenue

ROI Formula:

ROI = (Profit – Cost) ÷ Cost × 100

→ Attribute revenue using tracked links, promo codes, or post-purchase surveys.

Industry guides emphasize moving beyond vanity metrics toward revenue-aligned measures and offer practical models for tracking. Hootsuite Email continues to rank among the highest ROI channels, which is why owned list growth, deliverability, and testing belong in the core scorecard. EmailTooltester Content programs that live on owned surfaces produce compounding returns that support acquisition and retention. Content Marketing Institute

Hospitality operators should tie channel KPIs to direct booking share and contribution after acquisition cost. Distribution outlooks suggest a path toward larger direct digital share by 2030, which means the KPI architecture you install now becomes more valuable each quarter. Skift

Track your results.

Work off of one dashboard that reports by channel and by contribution.

Group KPIs by PESO for clarity:

- Paid: CPM, CTR, cost per view/click, CPA (weighted by margin)

- Earned: Impressions, sentiment, share of voice, referral conversions

- Shared: Engagement rate, saves, shares, UGC volume, creator reach & conversions

- Owned: Sessions, scroll depth, form fills, bookings/purchases, repeat rate, email growth & revenue

Measure profit, not vanity metrics.

ROI = (Profit – Cost) ÷ Cost × 100. Attribute revenue via tracked links, promo codes, or post-purchase surveys.

Six. Make Money With The Strategy

The goal is margin, not impressions. Here is how PESO becomes profit.

Reduce commission drag by moving repeatable demand into direct channels. Even a modest shift from OTA mix to direct improves contribution by the avoided commission range. Cloudbeds

Lower CAC with earned and shared. Third-party validation and UGC raise conversion rate and reduce paid media dependency at the margin. Recent market data shows brands evolving influencer portfolios toward micro and mid tier creators to increase engagement and cost efficiency. PR Newswire

Increase lifetime value through owned email and loyalty programs. Email remains one of the highest return channels and supports cross sell and repeat. DemandSage

Use retail media and digital video where they match category intent and carry measurable outcomes. Ad spend outlooks point to double digit growth in these areas as brands prioritize acquisition and performance metrics. IAB

Hotels should publish a channel contribution table monthly. Include booked revenue, acquisition cost, fulfillment cost variances if any, and net contribution. Tie exceptions to actions. When teams see the profit effect, they protect direct and allocate paid with discipline.

Reallocate just 5–10% of paid media spend from OTAs toward direct campaigns. Track the margin lift, even small shifts compound quickly.

Margin over impressions.

Even a modest shift from OTAs to direct can yield double-digit contribution gains. Protect direct business and allocate paid with discipline.

Seven. What To Keep In-House And Where To Partner

In-house ownership

Brand voice and community management so that the tone is consistent and responses are timely

Owned content maintenance on site and email so that updates are fast and accurate

Baseline analytics to validate weekly performance and flag anomalies

Partner with Billy Richards Consulting for:

Integrated PESO architecture that connects brand positioning with media roles and revenue targets

Creative direction that converts identity and guest or customer experience into platform-native stories

Cross-channel campaign planning with creator portfolios, cultural partners, and measurement plans

KPI dashboards that link social, PR, and paid to bookings or sales

Experience and partnership design that drives ancillary revenue in hospitality and brand extensions in fashion, tech, and CPG

A selection of some of our past and present project partners

Keep analytics, owned content, and brand voice in-house. Outsource execution-heavy work (e.g., influencer sourcing, large-scale media ops) to trusted partners.

Balance in-house control with expert leverage. Keep speed and accuracy by managing voice and data internally, while using partners for PESO integration and campaign scale without losing control.

Eight. Category Playbooks

Hotels and Hospitality

Narrative: Focus on guest identity and reasons to pay more. Spotlight suites, views, wellness, culinary, and cultural alignment.

Acquisition: Paid search for high intent, paid social for market entry, earned culture features, creator stays with clear disclosure.

Conversion: Direct booking offers pegged to value not rate. Loyalty and email nurturing.

KPIs: Direct share, contribution per channel, attachment revenue in stay.

Action: Design UGC programs with consent, guide rails, and reposting cadence. Run creator pilots across seasons. Leverage event calendars with partners to plan earned moments.

Fashion and Lifestyle

Narrative: Materials, silhouette, craft, and styling.

Acquisition: Seasonal paid bursts aligned to drops, editorial seeding for earned, micro creator styling series.

Conversion: PDP optimization and social shop links.

KPIs: New customer share, CAC by creator tier, repeat within 90 days.

Action: Create a modular lookbook template that feeds site, social, and email. Stand up a creator CRM.

Tech

Narrative: Product utility, social proof, and roadmap transparency.

Acquisition: Paid search and video, analyst relations for earned, developer or user community for shared.

Conversion: Trial to paid pathways, onboarding design.

KPIs: Trial conversion rate, payback period, activation milestones.

Action: Publish a quarterly insights piece as Owned gravity. Feed the best performing sections into short video and paid.

CPG

Narrative: Usage occasions, ritual, taste or performance.

Acquisition: Retail media plus paid social, creator unboxings for earned and shared.

Conversion: Retail media audiences, DTC bundles, repeat via email.

KPIs: Incremental sales in RMN, DTC repeat rate, creator assisted revenue.

Action: Build a measurement plan that pairs RMN reporting with site analytics. Industry sources show retail media and digital video expanding in 2026, which supports this investment. IAB

Action plays by sector:

- Hotels: design UGC repost programs and run creator pilots across seasons

- Fashion: build modular lookbooks feeding site, social, and email

- Tech: publish insights quarterly and repurpose into short video + paid

- CPG: align RMN reporting with ecommerce for full-funnel clarity

PESO execution is industry-specific, but the system stays consistent. Customize actions to sector needs while keeping measurement and integration uniform.

Nine. Data And Analytics To De-Risk Spend

Treat analytics as product. Install a source of truth that joins paid platform data, social engagement, PR placements, site analytics, booking or ecommerce revenue, and margin. Adopt a weekly scorecard with confidence intervals. Reference industry baselines so pacing is clear. Social ROI resources and calculators provide straightforward methods for tying outcomes to cost, which helps move budget toward what works. Social Media DashboardHootsuite

For hospitality specifically, use a distribution dashboard that reports the share from owned direct, OTA, brand.com if relevant, and other channels. Emerging research suggests direct digital will command greater share of bookings by 2030, so investments you make now in Owned and Shared will compound. Skift

Build a simple weekly scorecard. Track PESO metrics in one sheet and benchmark against industry baselines. It forces clarity and accountability without slowing teams down.

Treat analytics as a product, not a report. Join data across paid, earned, shared, and owned into one source of truth. Weekly scorecards make ROI transparent, defensible, and actionable.

Ten. Billy Richards Consulting Action Framework

1. Diagnose

Run a PESO architecture audit covering site performance, email health, social graph, creator portfolio, PR footprint, and paid accounts. Quantify distribution mix if you are a hotel operator and calculate net contribution after acquisition costs. Document positioning pillars and audience segments.

2. Design

Write a media thesis that links brand story to measurable outcomes. Define plays by funnel stage and by platform. Set a budget envelope and a target CAC or contribution threshold. Create a creator brief and PR calendar synced to product drops or key citywides.

3. Build

Stand up tracking, clean naming, and a simple attribution method you can explain. Produce the owned content spine first. Design social templates for speed. Recruit creators and cultural partners who match the story. Install dashboards with weekly and monthly looks.

4. Prove

Ship a 90-day pilot with 3 to 5 clear tests. Examples: creator tier test, CTA copy test, landing page variant, RMN placement type. Report results with error bounds and next steps. Keep the best, cut the rest.

5. Scale

Expand the top performing plays. Add spend to the combinations that meet CAC thresholds or contribution targets. Increase creator frequency where engagement justifies it. Introduce new partners as earned channels grow.

Pilot, prove, scale. Run 3–5 controlled tests in 90 days (creator tier, CTA copy, landing page variant). Keep what hits CAC/contribution targets and cut the rest. Double down on the winners.

Scaling is about discipline, not volume. Systematic testing and pruning create efficiency. The best plays get more spend, while weak ones are cut early, making growth predictable.

Eleven. The 90-Day Plan

Days 1 to 30

Conduct audit across PESO, distribution, and analytics.

Finalize positioning pillars and audience segmentation.

Build owned content spine: site pages, landing pages, email sequences.

Draft creator and PR briefs.

Stand up dashboards for paid, earned, shared, and owned.

Define tests and budget envelopes.

Days 31 to 60

Launch creator pilots and paid social or search activation.

Push earned stories to target outlets and cultural partners.

Publish two high value owned pieces that anchor search and email.

Drive UGC with on-property or on-brand prompts and consent.

Run 2 to 3 landing page or CTA experiments.

Days 61 to 90

Evaluate results against CAC or contribution thresholds.

Shift spend to top performing plays.

Plan season two with larger creator or partner footprint.

Lock in monthly governance: pricing or offer integrity, measurement quality, and brand safety protocols.

Break campaigns into 30-day sprints. Test creators, copy, PR hooks, and landing pages in fast cycles. Use each sprint to identify what drives CAC efficiency, then scale only the winners.

Think in 90-day cycles. Audit, design, launch, and measure within a 3-month window. This cadence keeps momentum high, ensures rapid learning, and doubles down on what meets contribution thresholds.

Twelve. Closing Synthesis And Call To Action

The integrated PESO model is not a trend. It is the operating system for brand growth in 2026 and beyond. Social is the amplifier. Owned is the compounding asset. Earned is the trust signal. Paid is the reach and precision. Hospitality operators can increase direct share and protect margin; fashion, tech, and CPG brands can lower CAC, scale launches, and build repeat. The outcome is clear: this system lowers acquisition cost, protects contribution, and compounds brand equity across channels.

Billy Richards Consulting partners with you as both creative strategist and operator. We align brand narrative, cultural partnerships, creator programs, and paid activation into a single, measurable system. We build dashboards, design experiments, and coach your teams. The outcome isn’t more content. It is more contribution and a stronger brand.

If you want a 90-day blueprint that turns your story into sales, attention into asset value, let us build it together.

Hospitality 2026 (Part 2): Technical Companion & Glossary

This glossary is designed as both a general reference for the hotel industry and a dedicated companion to Hospitality 2025: Twelve Strategic Shifts Driving Commercial Outperformance.

This glossary is designed as both a general reference for the hotel industry and a dedicated companion to Hospitality 2026: Twelve Strategic Shifts Driving Commercial Outperformance. It explains the technical terms, metrics, and concepts used in each section of the white paper. For the most seamless reading experience, we recommend opening this glossary in a separate tab and reading it alongside the white paper.

One. Advanced Revenue Architecture and Dynamic Profit Management

Revenue per Available Room (RevPAR) – Total room revenue divided by the number of available rooms for a given period.

Total Revenue per Available Room (TRevPAR) – All revenue streams combined, divided by available rooms.

Gross Operating Profit per Available Room (GOPPAR) – Profit after operating expenses, divided by available rooms.

Attachment Rate – Percentage of guests purchasing additional products or services beyond their room.

Rate Fences – Pricing rules that segment customers, such as advance purchase requirements or package deals.

Room Type Mix – Distribution of room categories sold and their contribution to revenue.

Add-On Offers – Extras sold alongside bookings, such as breakfast or spa credits.

Error Bounds – The range indicating potential variation in forecast accuracy.

Two. Capital Efficiency and Asset Repositioning

Internal Rate of Return (IRR) – Annualized growth rate expected from an investment.

Payback Period – Time it takes for an investment to recoup its cost.

Displacement Effect – Revenue lost when a lower-value booking replaces a higher-value one.

Capital Efficiency – Maximizing profit from each dollar invested.

Demand Gap Study – Analysis identifying unmet market demand by segment and season.

Three. Artificial Intelligence Decisioning and Predictive Commercial Intelligence

AI Decisioning – Machine learning systems making pricing, forecasting, or operational recommendations.

Model Drift – Decline in AI performance over time as market conditions change.

Governance Charter – Document outlining rules, responsibilities, and oversight for AI usage.

Scenario Log – Record of AI recommendations and human decisions for evaluation.

Four. Cross Sector Partnerships and Ecosystem Monetization

Ecosystem Monetization – Using partnerships to create new revenue streams, such as retail or wellness activations.

Revenue per Square Foot per Hour – Space valuation metric for events or retail.

Fixed Rent – Guaranteed payment for space usage.

Revenue Share – Percentage of sales paid to the property owner from a partner’s revenue.

Five. Labor Model Reinvention and Technology Enabled Productivity

Demand-Linked Scheduling – Aligning staffing schedules with forecasted occupancy and revenue peaks.

Productivity Index – Combined measure of labor cost, guest satisfaction, and ancillary revenue.

Upskilling – Training staff in new skills for increased flexibility and efficiency.

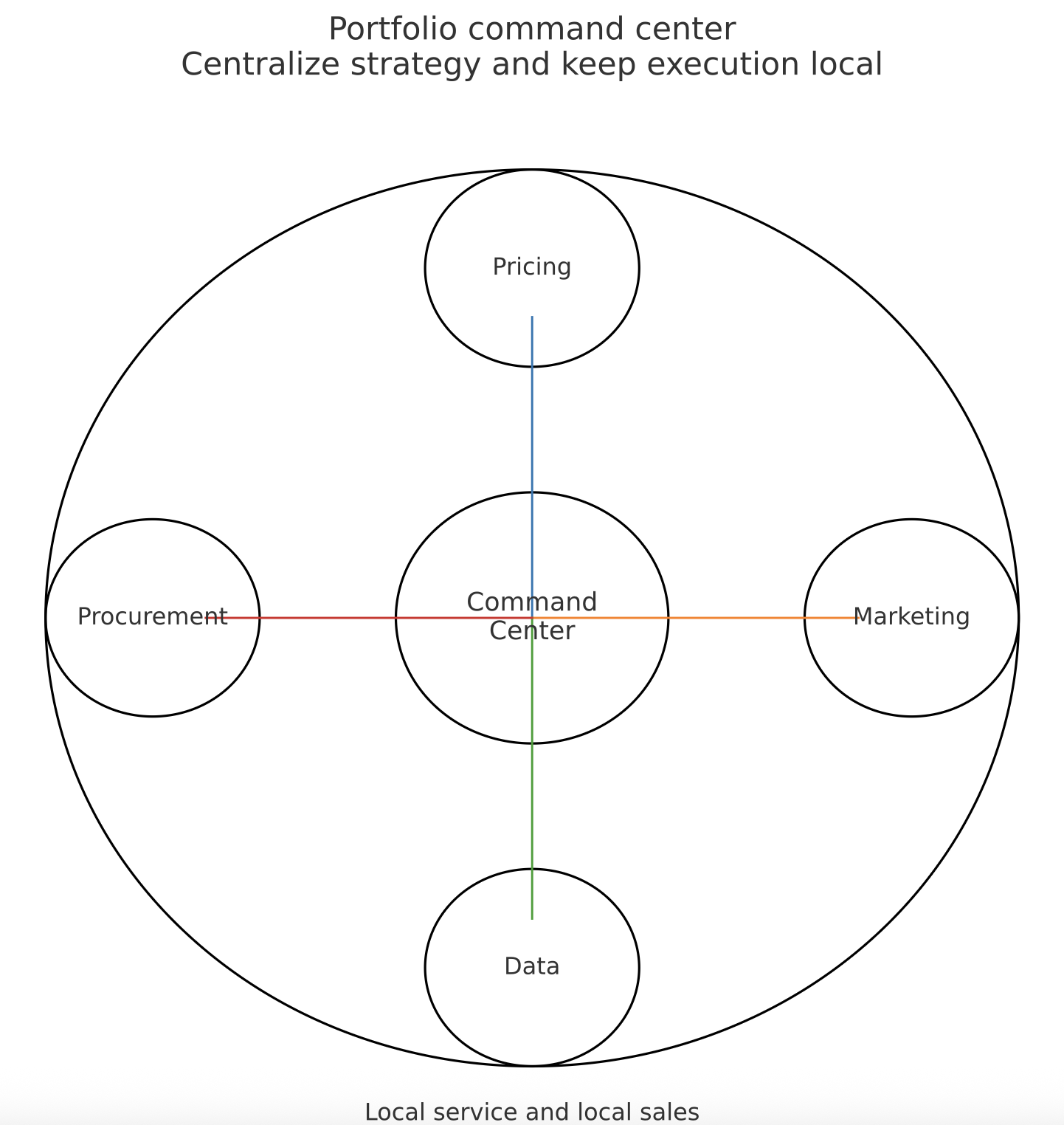

Six. Multi Asset Portfolio Synchronization

Portfolio Command Center – Centralized oversight for pricing, inventory, marketing, and procurement across properties.

Data Warehouse – Unified storage system for analytics and reporting.

Mix, Share, and Margin – Key performance indicators for portfolio-wide performance tracking.

Seven. ESG as a Commercial Lever

Environmental, Social, and Governance (ESG) – Framework for measuring sustainability, ethics, and social responsibility.

Eco Certification – Third-party verification of sustainable practices.

Carbon Reduction Metrics – Measurements of reduced emissions from operational improvements.

Eight. Resilience Through Cloud Based Infrastructure

Cloud Infrastructure – Internet-hosted systems enabling faster updates, scalability, and integration.

Event Streams – Real-time data flows between systems.

Application Interfaces (APIs) – Software connections allowing different systems to communicate.

Nine. Revenue Diversification Through Licensing and Brand Extensions

Brand Extensions – Selling products related to the property identity, such as bedding or fragrance.

IP Valuation – Assessment of brand intellectual property value.

Category Screen – Process for selecting product categories aligned with the brand.

Ten. Data Monetization and Commercial Intelligence Products

Data Trust – Framework for governing access, use, and pricing of aggregated data.

Anonymized Data – Data stripped of personal identifiers.

Metadata – Information that describes and provides context for datasets.

Eleven. Pricing Governance and Commercial Risk Management

Pricing Governance – Rules and processes ensuring consistent, brand-aligned pricing.

Rate Integrity – Maintaining consistent pricing that supports brand positioning.

Stress Testing – Modeling the impact of negative market events on pricing strategy.

Twelve. Direct Distribution and Loyalty Economics

Direct Mix – Percentage of bookings made through the hotel’s own channels.

Friction-Free Booking – Seamless, user-friendly reservation process.

Loyalty Benefits – Perks offered to repeat guests, often with high perceived value and low cost to the hotel.

Conclusion

This companion glossary is designed to be read along with Hospitality 2026: Twelve Strategic Shifts Driving Commercial Outperformance. By matching the order of the white paper, it allows readers to quickly reference definitions as they encounter them, ensuring a deeper and more accurate understanding of each concept. Mastery of these terms will help transform the strategies in the white paper into actionable, measurable outcomes.

Hospitality 2026: Twelve Strategic Shifts Driving Commercial Outperformance

A comprehensive board level briefing on twelve trends shaping hospitality in 2025 with advanced revenue systems, capital efficiency, AI decisioning, portfolio synchronization, cloud modernization, ESG profitability, and new revenue lines supported by BRC implementation playbooks.

For a complete glossary of hotel industry and strategy terms used in this white paper, open our companion guide in a new tab here.

Executive Summary

Hospitality in 2026 rewards integration over spending. With U.S. RevPAR projected flat to slightly negative and financing costs still elevated, outperformance comes from operators who:

Manage to TRevPAR and GOPPAR, not just ADR

Deploy AI for group pricing and cost forecasting, compressing decision cycles

Build high-margin partnership ecosystems beyond the room

Align labor deployment with hourly revenue curves using predictive scheduling

Synchronize portfolio pricing and procurement while preserving local service identity

Leverage ESG credentials to win corporate RFP share and reduce utility spend

Migrate to cloud infrastructure for real-time visibility and faster integration

Protect direct channel contribution through loyalty economics and friction-free UX

This blueprint provides twelve strategic shifts and actionable Billy Richards Consulting frameworks to operationalize within 90 days. The competitive edge in 2026 belongs to those who execute, not those who plan.

Introduction

Hospitality in 2026 is reshaping itself under the combined weight of cost inflation, fast-moving technology cycles, and a demand environment that varies by market and segment week to week. Many portfolios are now managing through slower rate growth and uneven occupancy while energy and payroll remain elevated. Recent outlooks reflect this reality. Independent researchers and banks have trimmed growth expectations for the United States through 2026, with some sources now calling for flat to slightly negative revenue per available room for the full year as higher prices meet softer pace and as corporate travel remains selective.

The Peninsula Istanbul Waterfront icon that blends heritage and modern luxury while anchoring mixed use revitalization along the Bosphorus

Global travel demand is still a bright spot. The United Nations World Tourism Organization reported that international arrivals recovered to pre-pandemic levels in 2024 and it projects additional growth of approximately 3% in 2025. That is an important tailwind for gateway cities and for destinations that depend on long-haul travelers. UNWTO. What’s next for 2026?

As we enter 2026, operators face a bifurcated landscape: gateway cities with strong international demand versus secondary markets managing softer corporate travel. The December 2025 Fed rate cut provides financing relief, but execution discipline—not capital availability—will separate outperformers from the field. At the same time the operating picture is complicated by persistent staffing challenges.

As of mid-2025, the American Hotel and Lodging Association reported that approximately 65% of surveyed hotels continued to face staffing shortages even after a year of improved recruitment and higher pay. The same association noted that employment is expected to grow in 2026 but that retention and new technology adoption remain critical to success. Immigration remains an important source of labor supply for the sector according to a June 2025 analysis. AHLA+1Reuters

Owners and operators who outperform in this environment are the ones who weld revenue science to asset strategy, who align labor with revenue moments, who move to cloud infrastructure for speed and reliability, and who treat partnerships and brand extensions as real growth levers rather than side projects. This document presents twelve strategic shifts and a complete set of BRC Action Frameworks so you can implement without guesswork.

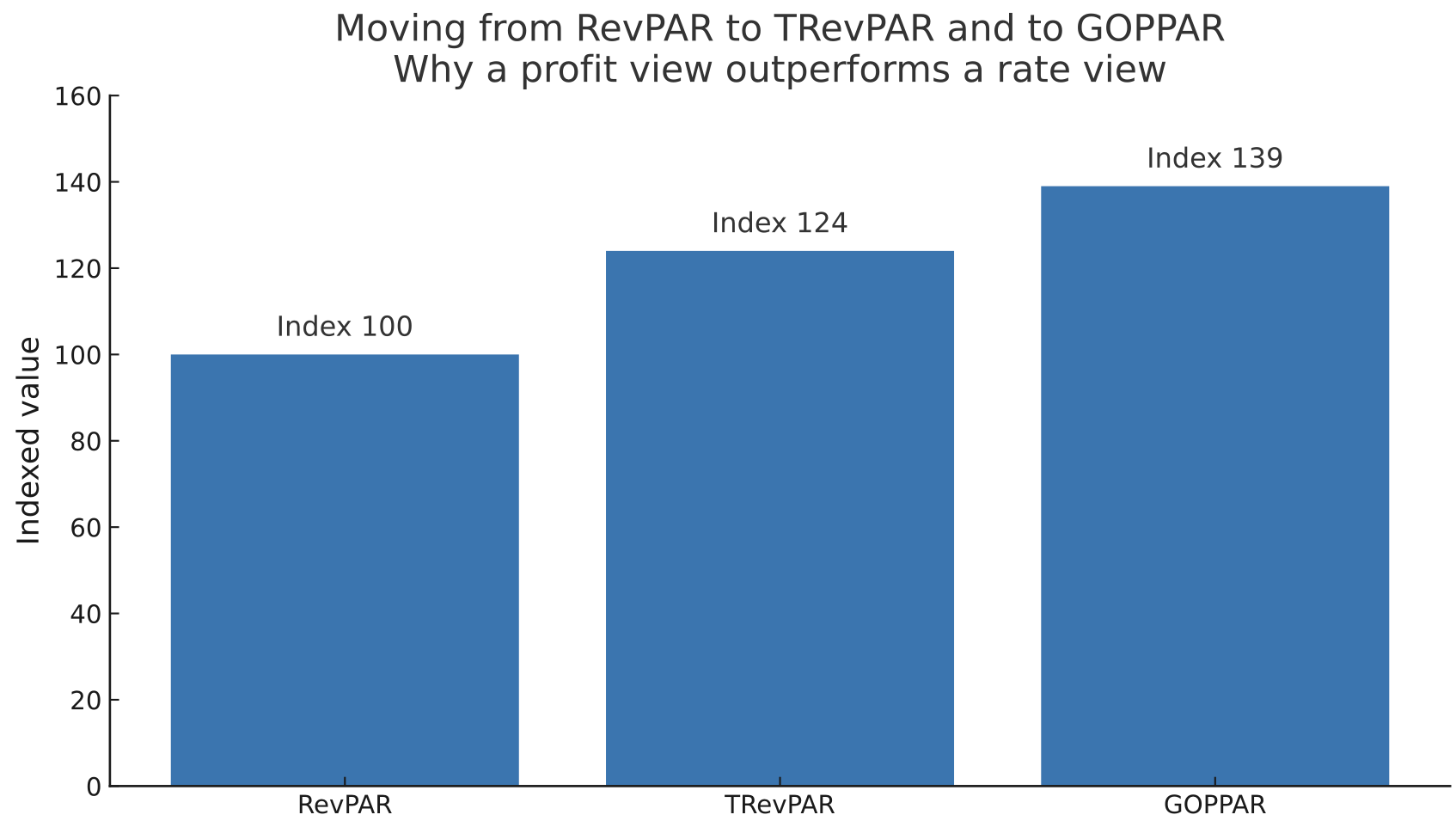

Managing to total revenue and to profit produces a truer view of performance than rate alone

(Concept index for communication. Not a market dataset. Replace with property or portfolio metrics if required.)

Methodology & Data Sources

This analysis draws on November–December 2025 industry reports from STR, CBRE, HVS, AHLA, UNWTO, and Cornell School of Hotel Administration. 2026 projections reflect consensus views across investment banks, valuation firms, and hospitality research institutions. Where data points reference 2025 performance, they represent the most recent available figures as of publication and are used to inform 2026 strategic positioning. All recommendations are designed for immediate implementation within Q1–Q2 2026.

One. Advanced Revenue Architecture and Dynamic Profit Management

Revenue per available room is no longer sufficient to steer a complex business. Leading portfolios manage to Total Revenue per Available Room and to Gross Operating Profit per Available Room because these measures capture both the scope of income and the cost required to earn it. Properties that adopted a total revenue lens during the last cycle reported meaningful profit lift by expanding the commercial plan to include food and beverage, spa, meetings, retail, parking, and in stay experiences. The modern revenue office operates as a profit center that unites sales, marketing, operations, and finance around one forecast that spans all lines.

Execution requires integrated data. Revenue management platforms must pull from property management, point of sale, labor, and customer relationship systems so that price and inventory decisions reflect real cost to serve and real attachment rates. Rate fences, room type mix, and add on offers should be tied to measurable changes in margin by segment and by channel.

Billy Richards Consulting Action Framework

Conduct a commercial architecture audit across property management, revenue management, point of sale, and customer systems. Build a single forecast that includes rooms, food and beverage, spa, events, parking, and retail. Replace weekly rate reviews with weekly profit reviews and track contribution by segment and channel with visible error bounds.

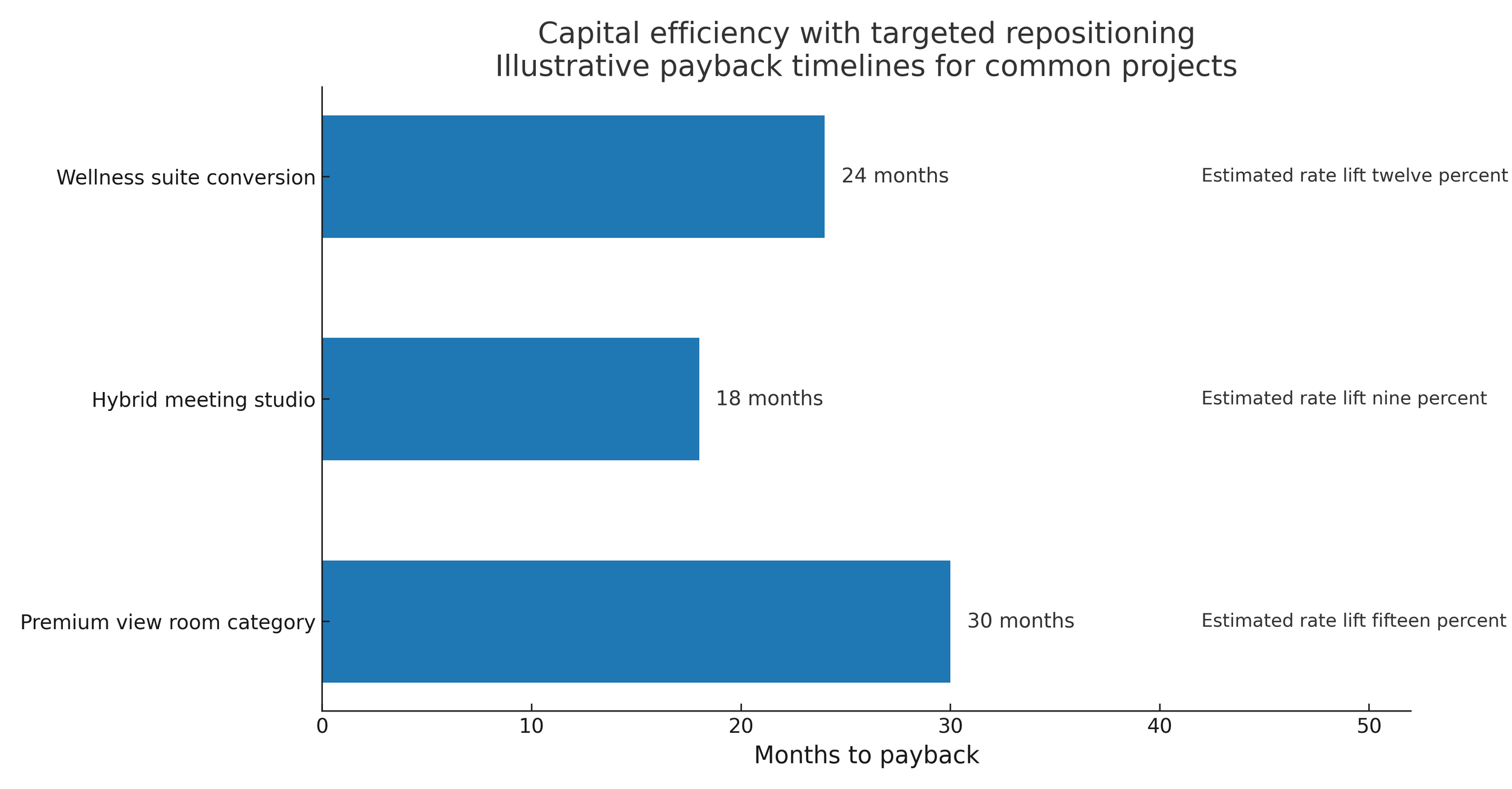

Two. Capital Efficiency and Asset Repositioning

With capital more expensive and selective, owners are favoring targeted repositioning over broad renovation. The most effective projects are those that convert under used footprints into higher yield concepts or that create premium room types with clear reasons to pay more. Examples include wellness suites that command stronger average daily rate, technology-rich meeting spaces that attract hybrid events, and curated retail that matches the guest profile. Independent valuation research shows that hotel values in Europe rose about 2.5% in 2024 as occupancy recovered and rate normalized, which underscores how targeted asset moves can support value even in a slower growth year. HVS

Targeted repositioning delivers faster payback than broad renovation when tied to real demand

(Illustrative values for communication. Replace with market or property data if required.

Inputs reflect common ranges reported by respected industry sources including HVS hotel cost guides and wellness revenue analyses from RLA Global and HotStats.)

Every dollar must be tied to a demand pool and a pricing story. A disciplined playbook models internal rate of return and payback under base and downside scenarios and it quantifies expected uplift by room type category and by ancillary line. Owners should also score the operational effect, including the cost of utilities and maintenance under the new concept.

Billy Richards Consulting Action Framework

Run a property level demand gap study that pinpoints the segments you can credibly win. Build an investment case with internal rate of return, payback, and displacement effects by month. Phase the program so that early wins fund later work and publish a monthly variance report against the pro forma.

Three. Artificial Intelligence Decisioning and Predictive Commercial Intelligence

Artificial intelligence is now a practical engine of commercial performance rather than a laboratory project. Hotels that adopted artificial intelligence for group pricing cut proposal times by large margins and lifted conversion. Similar systems predict attrition in corporate accounts and loyalty segments so that sales teams can intervene before spend declines. Others forecast cost to serve by booking type and arrival pattern which allows operations leaders to plan labor and purchasing more accurately. These improvements matter as operators face uneven performance heading into 2026. Mid-2025 data from STR showed U.S. occupancy near 64%, ADR around $160, and RevPAR essentially flat, reinforcing the need for precision tools as markets remain selective. STR

Artificial intelligence projects require clean data and governance. A pricing council that includes revenue, finance, sales, and brand should review outputs, monitor model drift, and ensure fairness. Start narrow, prove lift within a quarter, and scale only after wins are banked.

Leading revenue management vendors including IDeaS, Duetto, and Revinate now embed predictive AI as standard features, lowering adoption barriers for mid-market portfolios. Expect 2026 to be the year AI moves from pilot to production across forecasting, pricing, and guest personalization use cases.

Billy Richards Consulting Action Framework

Select one high value use case with solid data quality such as group pricing or demand classification. Deliver a ninety day proof with measured impact. Create a governance charter for model oversight and document decisions in a scenario log so leaders learn where the machine is strong and where human judgment must lead.

Four. Cross Sector Partnerships and Ecosystem Monetization

A hotel is a destination and a platform. Partnerships with retail, wellness, entertainment, and education can create high-margin revenue streams and strengthen brand differentiation. In practice this means a lobby that hosts a luxury retail capsule, a spa that carries a co-created product line, a calendar of cultural programming that is underwritten by partners, and event spaces that serve hybrid audiences both on site and online. The strongest programs present a coherent story that matches the property identity and the audience.

A successful partnership portfolio uses clear unit economics. Space is priced in revenue per square foot per hour and agreements balance guaranteed rent with revenue share where appropriate. Operational plans detail staffing, service standards, and merchandising. Data and marketing calendars are shared so that both sides can measure results and optimize.

Billy Richards Consulting Action Framework

Write a partnership thesis for each market that names target categories and partner profiles. Create a valuation grid for space and time. Choose between fixed rent, revenue share, or hybrid based on risk and return. Require joint planning, rights for data review, and defined performance thresholds for renewal.

Five. Labor Model Reinvention and Technology Enabled Productivity

Labor is the largest controllable expense and the most visible driver of the guest journey. The goal is not simply to cut hours but to align staffing with the revenue curve of the day and of the week. The sector still faces shortages. AHLA's Q1 2025 survey reported that 65% of U.S. hotels faced staffing shortages, a challenge that persists into 2026 despite wage increases averaging 4–6% year-over-year. AHLA+1 Employment is expected to grow in 2026 but retention and upskilling will matter as much as recruitment.

Winning operators rely on demand-linked scheduling, mobile work management, and streamlined guest technology for simple tasks. This frees colleagues for higher value interactions such as personalization, cross selling, and problem resolution. Cross training expands flexibility during peaks. The right scorecard joins labor cost, guest satisfaction, and ancillary attachment so teams can see the tradeoffs and make better daily decisions.

Billy Richards Consulting Action Framework

Implement a property productivity index that combines cost per occupied room, satisfaction scores, and in stay revenue attachment. Drive scheduling from the integrated forecast. Automate routine service flows and coach teams on simple talk tracks that reveal needs and position relevant add ons.

Six. Multi Asset Portfolio Synchronization

Scale produces advantage only when decision rights and data are centralized while local service remains personal. Portfolio leaders run a command center that unifies pricing rules, inventory strategy, marketing investment, and data governance. They share winning creative across properties and they coordinate regional promotions to manage demand across the set. This approach matters because growth has become uneven across markets. While the United States has experienced slower momentum at points in 2025, several South American markets have posted consistent revenue per available room gains through the year to date period supported by both rate and occupancy. Coordinated strategy allows owners to lean into out performing regions while supporting assets that face softer conditions. STR

A synchronized portfolio also consolidates procurement and energy programs to capture cost savings and to support environmental goals. Shared identity resolution and privacy controls reduce compliance risk and improve the quality of analytics across the group.

One governance model unites pricing, marketing, data, and procurement, while local teams execute service and sales

Billy Richards Consulting Action Framework

Stand up a portfolio command center with standard operating rhythms. Install a shared data warehouse with common definitions and one dashboard. Publish a weekly report on mix, share, and margin. Replicate successful offers across the set within weeks, not quarters.

Seven. ESG as a Commercial Lever

1 Hotel Brooklyn Bridge Urban sanctuary with a sustainability story that turns skyline views into brand equity and premium demand

Environmental, social, and governance performance is no longer a side conversation. It influences corporate request for proposal outcomes, investor interest, utility spend, and brand preference. The commercial upside is real. Cornell and NYU hospitality research confirms that LEED and Green Key certified hotels command 2–5% ADR premiums in competitive sets, with corporate RFP win rates 15–20% higher for properties with verified environmental credentials. Major chains including Accor and IHG have committed to portfolio-wide third-party certification by 2030, accelerating the competitive pressure on independent operators to match sustainability standards. Corporate travel programs have begun to reward measurable progress, with some initiatives showing higher win rates for hotels that can document credible environmental actions. Accor GroupSiteMinder

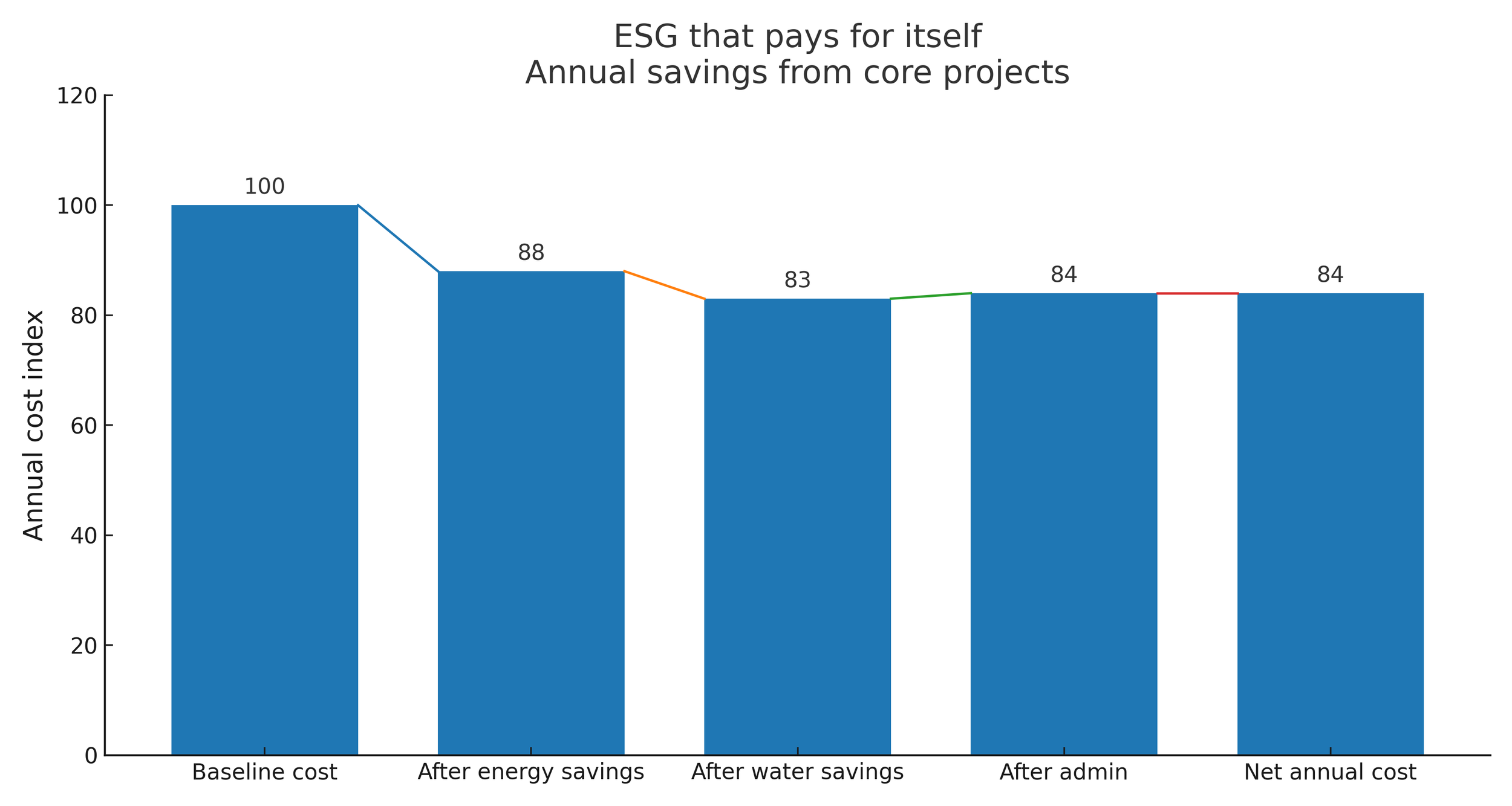

The sequence below shows the path from baseline utilities to net annual cost after energy and water savings:

Well-planned ESG work lowers cost and supports rate

(Illustrative values for communication. Replace with property data if required.)

Regulatory pressure is also rising in large cities, where emissions limits for buildings tighten through the decade. This further aligns sustainability with margin management since energy programs reduce both emissions and expense. Thoughtful storytelling turns these operational moves into rate support while also strengthening loyalty and employee retention.

Billy Richards Consulting Action Framework

Create a three year plan that quantifies expected effects on rate, corporate win rate, and utilities. Link ESG metrics to executive incentives. Report ESG in the same dashboard as financial metrics and show the operational projects that drive both carbon reduction and cost savings.

Eight. Resilience Through Cloud-Based Infrastructure

Portfolios that run on cloud systems move faster, integrate more easily, and gain real time visibility across the enterprise. Cloud-based property, revenue, and customer systems collapse deployment timelines for new features and for new properties and they reduce technology debt through modular updates. Several groups that completed migration reported lower information technology run costs and faster onboarding of new hotels. The benefits are particularly important in a year when operators need to spot softening pace early and react with precision. Industry research in mid-2025 highlighted quarters where modest rate growth was offset by lower occupancy which reinforced the need for live analytics and rapid response. CBRE

A modern stack uses event streams and application interfaces so that demand signals, rate decisions, and service events can connect without manual handling. Identity and access controls are standardized across all systems. Batch reporting is replaced by live dashboards configured for executives and for property teams.

Billy Richards Consulting Action Framework

Prioritize migration for the commercial stack first so the business case is visible. Map integration requirements, assign clear owners, and set service levels. Tie each technology milestone to a commercial metric such as forecast accuracy, lead time, direct mix, and labor productivity.

Nine. Revenue Diversification Through Licensing and Brand Extensions

Hospitality brands with strong equity can extend beyond the property to create new high-margin lines. Product families that relate to the property story such as sleep products, fragrance, homeware, and culinary goods build emotional connection and also generate incremental profit with relatively low operating complexity. Co-branded credit instruments and retail partnerships can add scale and marketing reach while feeding data back to the core loyalty program.

The key is discipline. Category selection should reflect the guest demographic and the brand promise. The financial model must include quality control, distribution, and marketing allocations. Post launch, the team should track attachment between product customers and on property revenue to confirm that the extension strengthens, rather than dilutes, the brand.

Billy Richards Consulting Action Framework

Complete an intellectual property valuation and category screen. Select two priority categories with strongest fit and one test category. Negotiate quality standards and distribution rights. Reinvest part of the profit into shared media that supports both the product line and the hotel.

The Calile Brisbane Lifestyle-led architecture where retail and programming drive strong ancillary revenue and repeat visitation

Ten. Data Monetization and Commercial Intelligence Products

Hotels produce valuable information about demand patterns, spend behavior, and seasonality. Leading groups now generate $50K–$250K annually from anonymized data products sold to tourism boards and regional airlines seeking booking pattern insights. Some portfolios have also collaborated with destination marketing organizations to co-produce analytics that help both sides capture share during key periods. The guardrails are essential. Programs must honor privacy laws and brand promises. Data sets should be structured to remove personally identifiable information and to present trends at a level that is commercially useful without exposing individuals. Properly designed, these products create a recurring revenue stream and position the brand as a thought leader in its city or region.

Billy Richards Consulting Action Framework

Establish a data trust that defines access, purpose, retention, and pricing. Package anonymized data into quarterly or monthly reports with clear metadata. Price by geography, frequency, and depth. Obtain legal and brand approvals and publish a transparent data statement for customers.

Aman Tokyo Quiet power and precision design that signal premium positioning and pricing authority in a global gateway city

Eleven. Pricing Governance and Commercial Risk Management

Dynamic pricing is essential in a slower growth year, but it carries real brand risk if handled without discipline. The answer is to install a formal governance process that protects rate integrity while still allowing for speed. A council formed by revenue, finance, sales, and brand leaders sets floors and ceilings by segment, defines approval limits, and reviews exceptions monthly. Stress testing against scenarios such as event cancellations or macro slowdowns helps leaders avoid reactive discounting. This matters because 2025 industry forecasts from CBRE and Business Travel News project continued pressure on 2026 growth, with several sources anticipating flat to modest RevPAR performance as operators manage rate integrity against softer demand signals. CBREBusiness Travel News

Governance also includes communication to frontline teams and to owners. Sales managers need clear deal desk rules and alternatives to rate, such as value adds, that do not erode contribution. Owners need transparent reporting that shows the consequences of overrides at the booking class level so that tradeoffs are visible and rational.

Billy Richards Consulting Action Framework

Publish a pricing charter with explicit rules and decision rights. Hold a monthly review to assess exceptions, customer feedback, and model drift. Track the profit effect of each override and use the findings in coaching and in next year planning.

Twelve. Direct Distribution and Loyalty Economics

Direct bookings improve margin and produce better data for personalization, but only if the value exchange is clear and the journey is effortless. The American Hotel and Lodging Association projected that average daily rate in the United States would set a new high in 2025 at just over $162. That higher price point raises the stakes for friction-free direct purchase and for loyalty benefits that customers actually want. Perks such as late checkout, a simple dining credit, or a room feature choice often carry lower cost and higher satisfaction than broad discounts. AHLA With the Federal Reserve's December 2025 rate cut, AHLA projects that 2026 ADR will exceed the 2025 high of $162, supported by improved financing conditions for development and acquisition activity. This monetary tailwind positions well-capitalized owners to capture share through targeted repositioning and direct channel investment.

A balanced channel strategy still uses intermediaries for reach and for specific segments, but it aims to move repeatable demand into direct channels where contribution is stronger. Paid media must be measured with clean attribution to ensure that spend follows profitable audiences. Lifecycle communication before the stay, during the stay, and after the stay should highlight high-margin add-ons and future visit incentives that are relevant to the guest profile.

Billy Richards Consulting Action Framework

Set explicit targets for direct mix by segment and track contribution after marketing and loyalty cost. Simplify the booking flow and improve room-type storytelling and imagery. Test two or three high value low cost benefits and retire those with low uptake or negative return.

Closing Synthesis and 90 Day Plan

The competitive edge in 2026 comes from integration.

Revenue science sets a profit-focused plan.

Asset strategy concentrates capital on the few moves that change rate and mix.

Artificial intelligence compresses decision time and raises accuracy.

Partnerships and licensing add high-margin revenue outside the room.

Workforce design aligns human effort with the revenue curve of the day.

Portfolio synchronization multiplies wins across markets.

ESG reduces cost and attracts premium demand.

Cloud infrastructure turns all of this into a faster, more reliable system.

Pricing governance protects contribution when pace softens.

Direct distribution improves margin and data quality for the next cycle.

The 2026 Execution Roadmap:

Q1: Audit commercial architecture, install profit-based KPIs, launch AI pilots

Q2: Scale winning AI use cases, launch partnership revenue streams, migrate priority systems to cloud

Q3: Implement ESG cost reduction programs, optimize direct channel conversion, test brand extensions

Q4: Lock 2027 capital allocation, document wins, expand portfolio synchronization

Your leadership cadence should mirror this system. Hold weekly profit reviews with forecast, mix, and labor productivity. Run monthly governance reviews for pricing, technology, and ESG. Use quarterly capital councils to decide and stage repositioning. Report to owners from a single dashboard that shows profit by segment and by channel with confidence intervals so that risk is visible and decisions are force ranked.

Use this Hospitality 2026: Twelve Strategic Shifts Driving Commercial Outperformance as your 90-day blueprint and partner with Billy Richards Consulting to bring it to life. The core framework can be live in as little as three months for many portfolios, with deeper optimization in the following quarter. We align data and decision rights, install the cadence, and equip teams to execute. You gain a clear line from strategy to contribution and from contribution to asset value.

Contact Billy Richards Consulting below to schedule a thirty-minute conversation or request a private briefing.

Written by BILLY RICHARDS

For more information, contact:

The Future of Guest Experience: Eight Hospitality Trends Defining 2025

Discover eight defining hospitality trends for 2025, from hyper-personalization and AI-driven concierge services to seamless tech-human integration and sustainable luxury.

A grand yet modern luxury hotel interior bathed in warm light, featuring bespoke furniture and curated art.

Introduction: Hospitality in the Age of Expectation

Luxury hospitality has entered a new era. Guests expect the speed of a premier delivery service, the personalization of a streaming platform, and the elegance of classic service all in a single stay. In this climate, patience is short and competition is global. The winners are brands that treat innovation as an amplifier for human connection rather than a replacement for it. The strongest properties court culture, design, and technology with equal fluency. They orchestrate the full journey from the first search to the final follow up, and they do so with clarity, confidence, and care.

Billy Richards Consulting works with luxury hotels, lifestyle resorts, and forward thinking hospitality groups to bridge this divide. The consultancy shapes brand narratives, elevates guest experience, and aligns internal culture so that every touchpoint delivers meaning as well as beauty. What follows is a view of eight trends that are defining 2025 and a practical lens on how to translate them into growth. The purpose is simple. Help leaders move from trend awareness to measurable advantage while preserving the grace and nuance that make hospitality special.

Luxury hotel entrance that signals welcome and ease.

One. Hyper Personalization Moves Beyond Names and Preferences

Personalization once meant a welcome card and a remembered drink order. In 2025 it means anticipatory care across the full journey. Properties are unifying guest profiles across reservations, front office, culinary, spa, and loyalty. With that foundation, artificial intelligence can surface timely suggestions and human teams can deliver them with discretion. In practice this looks like climate, scent, and lighting set to a guest profile before arrival. It looks like a culinary team that quietly steers menus toward needs such as low inflammatory choices or mindful sugar. It looks like a spa therapist who greets a guest by understanding recent travel strain and time zone effects without an awkward intake.

This is not surveillance. It is hospitality that remembers and responds. The difference is tone and training. Data is a prompt. People are the delivery. The property that blends both builds trust and lifts average spend because guests feel understood rather than managed.

What this means for hotels. First, unify data. Second, design soft scripts that help teams offer without pressure. Third, define clear privacy choices and state them in plain language. Personalization works best when it feels like a gift, not a task.

Curated guest experiences elevated through expert knowledge and personal connection in a luxury hotel setting.

Two. Hotel Retailing Becomes Experiential