The Convergence Imperative

2026 Strategic Framework for Hospitality Real Estate & Brand Integration

How Mixed-Use Hotel Development, Branded Residence Investment, and Lifestyle Brand Strategy Are Reshaping a $6 Trillion Market

Executive Summary: The $6 Trillion Convergence Opportunity

The hospitality industry is undergoing its most significant structural transformation in decades. The boundaries that once separated hotels, restaurants, real estate development, and brand building have dissolved. In their place, a new competitive logic has emerged: convergence.

This is not a trend. It is a structural shift in how value gets created.

This white paper presents ten strategic shifts defining the convergence imperative for hospitality owners, operators, and developers. The analysis synthesizes research from STR, CBRE, HVS, PwC, Baker McKenzie, Savills, Knight Frank, and WATG Advisory with two decades of advisory work across hotel repositioning, mixed-use development, and brand strategy.

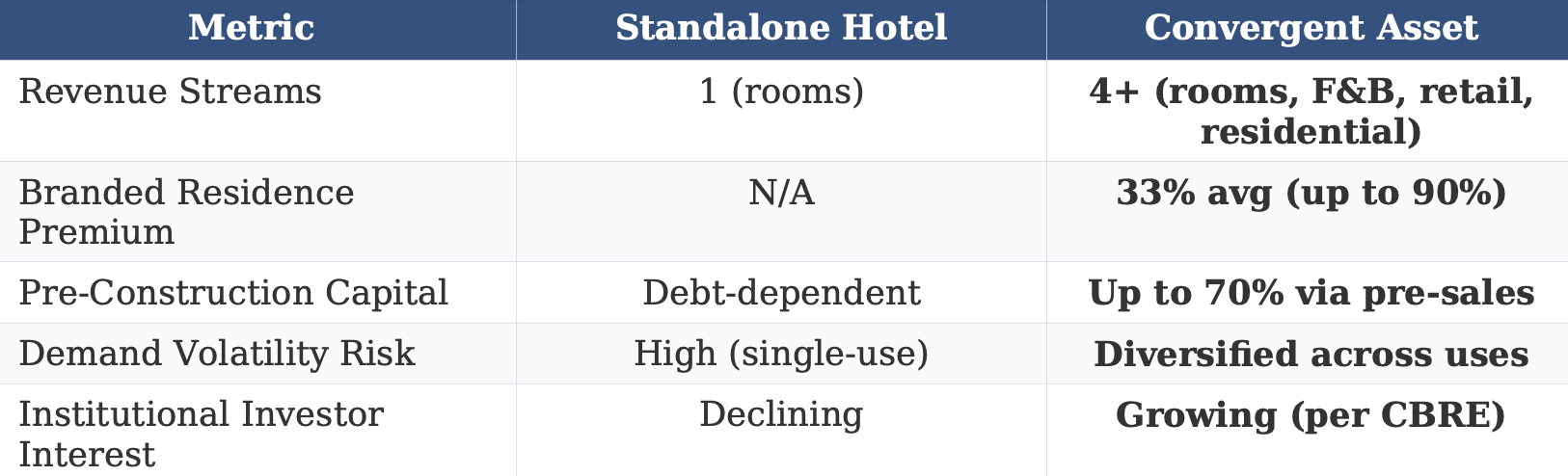

Standalone vs. Convergent Assets: The Performance Gap

The following comparison illustrates why institutional capital is shifting toward convergent hospitality assets:

The Core Thesis

A hotel is no longer merely a place to sleep. It is a platform for lifestyle expression, community creation, and multi-generational wealth building. The brands that will define the next decade are those that treat hospitality as strategy, not service.

Key Market Data

Branded residence investment premiums average 33% globally, exceeding 47% in emerging markets and 90% in select Dubai developments. Over 700 schemes now operate worldwide.

74% of diners now choose hotel restaurants as destinations, reversing decades of perception that hotel F&B represents compromise.

70% of loyalty members consider out-of-hotel benefits important, driving lifestyle brand ecosystem development.

Hospitality cap rate trends show a 202 basis point reset in Q3 2025, creating the most attractive asset repositioning opportunity in over a decade.

The Dissolution of Industry Boundaries

For decades, hospitality operated within clearly defined lanes. Hotels were lodging assets measured by RevPAR and occupancy. Restaurants were food and beverage operations measured by covers and check averages. Real estate development was a construction discipline measured by cost per key and time to stabilization. Brand building was a marketing function measured by awareness and sentiment.

These boundaries have collapsed.

The most compelling hospitality projects of 2025 defy categorization. The Langham Jakarta combines a luxury hotel with the 25hours Hotel The Oddbird, the ASHTA Mall, and the Treasury Tower office building in a single integrated development. Bluewaters Island in Dubai blends Banyan Tree and Delano hotels with branded residences, destination dining, retail, and the landmark Ain Dubai observation wheel. The Langsuan district in Bangkok, anchored by the Kimpton Maa-Lai and Sindhorn Kempinski, has become one of the city's premier dining and lifestyle destinations.

The macroeconomic environment of 2026 demands this convergent approach. With U.S. RevPAR projected flat to slightly negative and construction costs, insurance premiums, and debt service elevated, traditional single-use development economics have become increasingly challenging.

1. Mixed-Use Hotel Development Strategy: Why Standalone Assets Underperform

The standalone hotel is becoming an increasingly difficult investment thesis. Rising construction costs, elevated debt service, and margin compression from labor and insurance have shifted institutional capital toward mixed-use developments that distribute risk across multiple revenue streams while creating synergies that enhance each component.

Gensler's 2025 analysis of retail-driven mixed-use environments identifies hotels as integral contributors to urban vibrancy. A hotel provides a built-in customer base for ground-floor retail and dining. Those activated uses create reason for guests to choose the property over competitors.

The Design Imperative for Mixed-Use Integration

Hotels within mixed-use developments must create natural connections with pedestrian zones, retail corridors, and public spaces. A hotel lobby is no longer a check-in area. It is an active social space featuring cafes, bars, boutiques, and programming that draws both guests and locals.

Strategic Recommendations

Conduct site utilization audits to identify underutilized parcels.

Model revenue scenarios for hotel-only versus mixed-use configurations.

Establish partnership frameworks with retail, F&B, and residential developers before project inception.

Dissection + optimization

2. Branded Residence Investment: The 33% Premium Opportunity

Branded residences have emerged as one of the most compelling asset classes in hospitality real estate. Over 700 branded residence schemes operate globally, with an equal number in development.

Developer Value: Pre-Sales as Construction Capital

Branded residences provide early capital returns through pre-sales funding subsequent construction phases. Deposits of up to 70% before handover reduce financing exposure and may eliminate debt reliance entirely

Brand Value: Permanent Ownership Relationships

The residential component extends guest relationships beyond transient stays to permanent ownership. Management agreements generate fees of 2-3% of property value and rental income. Residential owners become brand ambassadors.

Buyer Value: Premium Performance

Savills reports branded residence premiums of 33% globally, exceeding 47% in emerging markets and reaching 90% in select Dubai developments. Knight Frank notes significant shift toward standalone branded residences driven by demand for privacy.

3. Hotel F&B Brand Strategy: The 74% Destination Dining Shift

Food and beverage has transformed from departmental cost center to active driver of brand identity, guest acquisition, and community integration. F&B now defines competitive position and justifies meaningful rate premiums.

Hotel Management's 2025 survey found 74% of diners choosing hotel restaurants as destinations. This reverses decades of perception that hotel F&B represents compromise.

F&B Brands Crossing Into Hospitality

Nobu Hotels demonstrates how culinary identity anchors entire guest experiences. Sunset Hospitality's METT Singapore shows how entertainment-led F&B concepts define hotel positioning from inception.

Nobu Hotels, Atlanta

Strategic Recommendations

Audit F&B operations for destination potential.

Identify opportunities to create distinct sub-brands.

Evaluate partnership models with established operators who bring built-in audiences.

4. Lifestyle Brand Ecosystems: Why 70% of Loyalty Members Want More

The most valuable hospitality brands in 2026 are not hotel companies. They are lifestyle ecosystems that happen to include hotels. This distinction shifts strategic focus from optimizing properties to building interconnected platforms capturing guest value across multiple touchpoints.

The Loyalty Evolution

Global Hotel Alliance's 2026 survey: 70% of loyalty members consider out-of-hotel benefits important. Younger travelers view loyalty programs as personal ecosystems extending into dining, wellness, shopping, and lifestyle.

The Aman Model

Aman exemplifies the realized lifestyle ecosystem. Aman Beverly Hills, with six- figure nightly rates, offers access blending: hotel, residences, and private club membership. Guests purchase membership in a community defined by shared aesthetic values.

The entrance to the Aman, Beverly Hills

Strategic Recommendations

Map guest journeys beyond the property to identify lifestyle touchpoints.

Prioritize categories with emotional resonance and defensible brand fit.

Structure licensing agreements protecting integrity while enabling expansion.

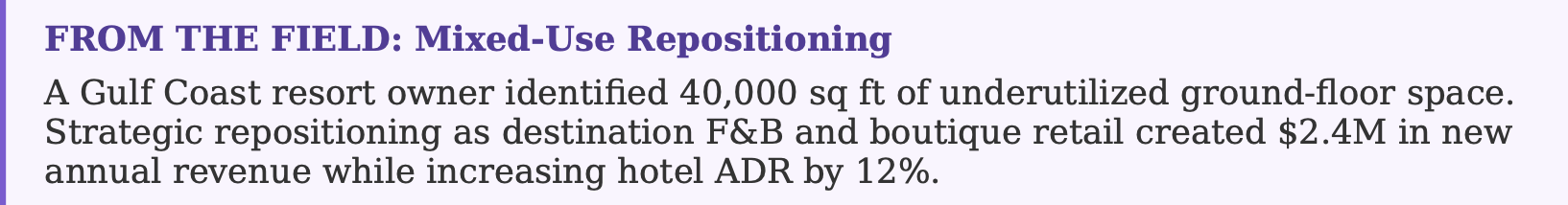

5. Hospitality Asset Repositioning: The 202 Basis Point Opportunity

Development economics in 2026 favor repositioning over new construction. Rising costs, constrained capital, and ESG pressures are driving investors toward renovation strategies unlocking embedded value in existing assets.

The Current Opportunity Window

Crexi's 2026 Outlook confirms: after two years of transaction paralysis, capital is returning selectively, with cap rates jumping 202 basis points YoY. This reset has created the most attractive basis levels in over a decade.

Three Dimensions of Effective Repositioning

Effective repositioning addresses three dimensions in coordination: physical refresh of guest-facing spaces, operational restructuring aligning staffing with target positioning, and narrative repositioning reframing property identity.

6. Strategic Partnership Architecture for Complex Projects

Converged hospitality projects demand partnership structures aligning diverse stakeholders. Developer, operator, brand, F&B partner, retail tenant, and residential buyer each bring different objectives. Partnership architecture determines whether projects achieve synergy or succumb to friction.

The Branded Residence Partnership Template

Baker McKenzie identifies branded residences as template for effective architecture. Typical structures separate capital ownership (developer and buyers), operational management (hotel brand), and brand licensing with clear definitions of responsibilities, fees, and standards.

F&B Partnership Models

Rather than operating restaurants internally, hotels increasingly partner with established culinary operators bringing proven concepts, trained teams, and built-in audiences.

Strategic Recommendations

Define partnership criteria including track record, brand alignment, and financial capacity. Structure agreements with performance benchmarks, cure periods, and exit provisions.

The Bulgari residences in Dubai

7. ESG in Hospitality: From Optional Reporting to Requirement

Environmental, social, and governance considerations have moved from optional reporting to fundamental development criteria. Regulatory pressure, investor requirements, guest expectations, and operational economics now align around sustainability.

Regenerative Hospitality

Baker McKenzie's 2025 analysis notes regenerative hospitality emerging as new standard. Operators aim to positively impact environments and communities rather than merely minimize harm.

The Commercial Case

Properties with verified environmental credentials report higher win rates in corporate RFPs. ADR premiums of 2-5% for certified properties are documented. Accor and IHG have committed to portfolio-wide certification by 2030.

Strategic Recommendations

Establish baseline carbon, water, and waste metrics.

Develop five-year sustainability roadmaps with quantified targets.

Pursue third-party certification.

Aim to create mindful experiences to guide your guests towards transformative moments

8. Technology-Enabled Placemaking in Mixed-Use

Technology's role has evolved beyond operational efficiency to a fundamental placemaking element. Properties defining 2026 integrate technology as invisible infrastructure enhancing human connection across venues.

AI and Unified Guest Intelligence

PwC identifies AI adoption accelerating across hospitality. The significant development is integration across mixed-use environments, creating platforms recognizing guests whether checking in, dining, shopping, or visiting the spa.

The Human Element

Technology should augment staff capability rather than replace human warmth. The goal is freeing team members from routine tasks to focus on genuine connections defining exceptional hospitality.

Strategic Recommendations

Audit technology infrastructure for integration capability.

Establish common guest identity standards across venues and partners.

Tech-Enabled Placemaking has potential to create massive impact

9. Community Integration as Competitive Advantage

The most successful developments of 2026 achieve genuine community integration. This is fundamental strategic choice affecting site selection, design, operations, and long-term value.

The Neighborhood Anchor Model

A hotel functioning as neighborhood anchor, providing programming, employment, and gathering space, builds stakeholder relationships translating into regulatory preference, community support, and advocacy reducing acquisition costs.

Workforce Development

Operators prioritizing local talent recruitment and development build loyalty and institutional knowledge improving service quality over time.

Strategic Recommendations

Conduct community stakeholder mapping.

Develop programming including locally-oriented events.

Establish workforce pipelines creating career pathways.

Imagine your project as a meeting place for its community

10. Portfolio Strategy for Convergent Assets

Hospitality real estate convergence demands corresponding portfolio strategy evolution. Traditional approaches evaluating hotels as standalone assets must yield to frameworks capturing value across multiple use types.

Market Opportunity

Mordor Intelligence reports hospitality real estate at $4.91 trillion in 2025, projecting $6.04 trillion by 2030 (4.23% CAGR). Fastest growth at 6.14% CAGR projects for Middle East and Africa.

The Synergy Premium

Mixed-use developments outperform standalone portfolios because components contribute demand and value to each other. Residential buyers become hotel guests. Hotel guests become restaurant customers. CBRE confirms institutional investors increasingly back these projects.

Strategic Recommendations

Evaluate existing portfolio for convergence potential.

Develop acquisition criteria prioritizing mixed-use sites.

Establish portfolio platforms enabling cross-property synergies.

2026 Implementation Roadmap

Hospitality real estate convergence is a structural transformation redefining value creation. Operators recognizing this shift will capture disproportionate returns.

Q1 2026: Assessment

Conduct convergence audits across portfolio. Identify priority assets for repositioning, mixed-use expansion, and branded residence development.

Q2 2026: Pilot

Launch pilot initiatives at 2-3 priority properties. Implement unified technology platforms. Develop ESG roadmaps.

Q3 2026: Scale

Scale successful pilots. Execute partnership agreements. Advance branded residence development for qualifying assets.

Q4 2026: Consolidate

Lock 2027 capital allocation. Document metrics demonstrating value creation from integrated strategies.

Schedule a Convergence Strategy Session

This framework represents a strategic foundation. Execution requires expertise in hospitality operations, real estate development, and brand building, combined with judgment in navigating convergent project complexity.

Billy Richards is the founder of Billy Richards Consulting, a hospitality strategy practice specializing in convergent asset development, brand positioning, and guest experience design. With two decades of advisory experience spanning luxury hotels, mixed-use developments, and lifestyle brands, Billy has worked with Fairmont, The Standard, LVMH, Diageo, Samsung, Lincoln Center, and leading developers across North America, Europe, and LatAm.

Case Outcome (NYC-based Real Estate Developer)

Engagement areas:

• Convergence audits and portfolio strategy

• Mixed-use project advisory and partnership structuring

• Branded residence feasibility and development strategy

• F&B repositioning and operator identification

• Asset repositioning: physical, operational, and narrative

• ESG roadmap development and certification strategy

Ready to explore what convergence means for your portfolio?

Schedule a Convergence Strategy Session

Billy Richards Consulting

Hospitality Strategy & Brand Development

Gramercy Park, New York City

© 2026 Billy Richards Consulting. All rights reserved.